The post Small Business Loans for New Businesses — Fast, Flexible, & Transparent Funding by Lending Valley appeared first on Lending Valley - Trusted Merchant Cash Advance Company.

]]>Traditional banks make it even harder for startups. They typically require a long operating history, demand collateral, and enforce strict credit score requirements. For many new business owners, this creates a feeling of being “locked out” of the financial support necessary to grow and succeed.

Lending Valley understands these challenges and has built a funding system specifically designed for new businesses. With fast approvals, flexible credit requirements, transparent terms, and reliable, on-time credits, entrepreneurs can focus on growth rather than worrying about whether their funding will arrive. If you’re starting a business in 2025, here’s how to get the financial support you need — even with limited history.

What Is a Small Business Loan for New Businesses?

A small business loan for new businesses is specifically designed to help early-stage companies access the capital they need to launch and grow. These loans provide funding to cover startup expenses such as inventory, equipment, marketing, software, hiring, and operational costs while helping stabilize cash flow during the critical first months.

Unlike traditional bank loans, which often require long business histories, high credit scores, and collateral, these loans are tailored to the unique needs of entrepreneurs just starting out. Many new businesses qualify for non-traditional funding solutions that prioritize potential, revenue projections, and business plans rather than years of financial statements. By leveraging these options, startups can gain quick access to capital, maintain flexibility, and focus on growth without being held back by conventional lending barriers.

Types of Small Business Loans for New Businesses

Working Capital Loans:

Provide flexible funding for day-to-day operations, covering payroll, rent, and inventory. Ideal for startups needing consistent cash flow without long-term obligations.

Merchant Cash Advances:

Advance against future sales revenue, offering fast funding with repayment linked to daily credit card transactions or revenue percentage, perfect for seasonal fluctuations.

Revenue-Based Financing:

Funding based on projected or current revenue, allowing repayments to adjust with income. Startups benefit from scalable repayments aligned with cash flow.

SBA Microloans:

Small loans backed by the SBA, supporting equipment, inventory, or working capital. Designed for startups with limited history but strong business potential.

Personal-Backed Startup Loans:

Loans secured with personal credit or assets, providing funding to cover early expenses when business credit is not yet established.

Equipment Financing:

Loans specifically for purchasing necessary equipment or machinery, enabling new businesses to operate efficiently without draining working capital.

Important: Many new businesses qualify for non-traditional funding — even without years of financial records.

Why New Businesses Struggle to Get Traditional Loans?

Many new businesses struggle to secure traditional bank loans—especially startups—because the majority of small bank lenders cite missing documentation, credit history, and lack of assets as major obstacles. In fact, nearly half of small businesses report rejection due to insufficient credit history or collateral. (Source)

| Challenge | Why It Happens |

|---|---|

| No operating history | New ventures often lack two or more years of financial statements, so banks view them as too risky for large, long-term commitments. |

| No collateral | Without existing assets like real estate or equipment, startups can’t satisfy traditional banks’ demand for security. |

| Low or limited credit | Many founders are still building their personal credit—or their business credit doesn’t yet exist, making approval hard. |

| Slow approval process | Underwriting often takes 4–8 weeks, because bankers require extensive documentation, verification, and risk assessment. |

| High rejection rates | Banks label early-stage companies as “high risk,” so many applications are declined, even if the business has potential. |

Best Small Business Loan Options for New Businesses

A. SBA Microloans:

SBA Microloans provide small loans up to $50,000, designed for early-stage businesses needing capital for equipment, inventory, or working capital. Approval can be slow due to extensive documentation.

- Loan amounts up to $50,000

- Ideal for startups and small businesses

- Requires business plan and projections

- Longer approval process (weeks)

- Helps build business credit

B. SBA 7(a) Startup Loans:

SBA 7(a) Startup Loans offer competitive rates for new businesses with solid financials and personal credit. These loans are suitable for larger funding needs but have stricter eligibility requirements.

- Competitive interest rates

- Requires strong personal credit

- Larger funding amounts available

- Collateral may be required

- Longer processing and documentation

C. Business Credit Cards (Early Stage Funding):

Business credit cards allow startups to cover small, immediate expenses such as software, office supplies, or marketing. Careful management is required to avoid high-interest costs.

- Quick access to capital

- Useful for small purchases

- Builds business credit history

- High interest if unpaid

- Flexible repayment schedule

D. Revenue-Based Financing (Ideal When You Start Making Sales)

Revenue-based financing ties repayment directly to your sales, making it ideal for businesses generating predictable revenue but without long-term debt obligations.

- Repayment adjusts with sales

- No fixed monthly payments

- Ideal for early revenue growth

- No collateral required

- Flexible funding amount

E. Merchant Cash Advances (MCAs) — Fastest Option:

MCAs advance cash based on future card sales, providing quick funding for startups. They require minimal documentation and can be approved in as little as 24 hours.

- No collateral required

- Approval in 24 hours

- Repayment based on sales

- Quick access to cash

- Flexible for seasonal businesses

F. Lending Valley’s Startup-Friendly Loans:

Lending Valley offers same-week approvals for startups with just 3–6 months of revenue history. The process is simple, transparent, and designed to get funds fast.

- Minimal documentation required

- Same-week approvals

- Only 3–6 months revenue history

- Transparent terms and fees

- Flexible repayment options

New ventures often face unexpected hurdles, and when you can’t afford to wait weeks for a bank decision, our platform delivers quick funding for small business owners to keep operations moving.

Best Small Business Loan Options for New Businesses

Here’s a quick rundown of the best small business loan options:

1. SBA Microloans

SBA Microloans provide small business funding up to $50,000, ideal for early-stage businesses needing working capital, inventory, or equipment. While the loan offers great support for startups, the approval process can be slow and requires detailed documentation.

- Loan amounts up to $50,000

- Perfect for startups and micro-businesses

- Requires business plan and projections

- Longer approval process (weeks)

- Helps build business credit

2. SBA 7(a) Startup Loans

SBA 7(a) loans are designed for startups seeking larger capital with competitive rates. Applicants must have strong personal credit and solid financials, making it suitable for businesses that plan significant growth from the outset.

- Competitive interest rates

- Requires strong personal credit

- Larger funding amounts available

- Collateral may be required

- Longer processing and documentation

3. Business Credit Cards (Early Stage Funding)

Business credit cards provide immediate capital for small purchases like office supplies, marketing, or software. They help startups manage short-term expenses, but high-interest rates require careful planning to avoid debt accumulation.

- Quick access to capital

- Ideal for small expenses

- Builds business credit history

- High interest if unpaid

- Flexible repayment schedule

4. Revenue-Based Financing (Ideal When You Start Making Sales)

Revenue-based financing offers loans that tie repayment directly to sales revenue. This is ideal for startups generating early income, providing flexible repayment without fixed monthly obligations or heavy collateral requirements.

- Repayment adjusts with sales

- No fixed monthly payments

- Suitable for early revenue businesses

- No collateral required

- Flexible funding amount

5. Merchant Cash Advances (MCAs) — Fastest Option

MCAs provide rapid cash by advancing funds against future card sales. With minimal paperwork, no collateral, and approvals in as little as 24 hours, they are ideal for startups needing fast, flexible capital.

- No collateral required

- Approval in 24 hours

- Repayment tied to sales

- Quick access to funds

- Flexible for seasonal revenue

6. Lending Valley’s Startup-Friendly Loans

Lending Valley specializes in startup-friendly funding with approvals in the same week, requiring only 3–6 months of revenue history. Minimal documentation and transparent terms make these loans fast, reliable, and predictable.

- Minimal documentation required

- Same-week approvals

- Only 3–6 months revenue history

- Transparent terms and fees

- Flexible repayment options

Read More: State vs Federal Business Financing Programs — How to Find Local Funding in Your State

How Much Funding Can a New Business Get?

Securing the right amount of funding is one of the most critical steps for a new business. The amount needed depends on startup expenses, operational costs, marketing, inventory, equipment, and anticipated cash flow requirements. Each funding source has different eligibility criteria, repayment structures, and limits. Traditional banks typically offer higher funding amounts but require strong personal credit, collateral, and a business history.

SBA loans are designed for smaller startups, providing reliable government-backed funding with moderate interest rates but slower approval times. Online lenders offer a faster alternative, often approving loans within days, though interest rates may be higher. Lending Valley focuses on early-stage businesses, requiring minimal documentation and just a few months of revenue history. The funding amount depends largely on business size, revenue, and purpose of the loan.

Understanding these ranges helps entrepreneurs choose the best option, plan budgets effectively, and avoid under- or over-borrowing. Fast access to the right amount of capital ensures new businesses can launch confidently and sustain growth.

Typical Funding Ranges:

SBA Loans: $5,000 – $250,000

Designed for small startups, SBA loans provide reliable capital for early-stage needs with government backing and moderate interest rates.

Banks: $50,000 – $500,000

Traditional banks offer larger loans for well-documented businesses, requiring collateral and strong credit histories for approval.

Online Lenders: $10,000 – $300,000

Fast approvals, flexible terms, and minimal paperwork make online lenders ideal for startups needing quick access to capital.

Lending Valley: $10,000 – $500,000

Funding depends on early revenue; minimal documentation, same-week approvals, and transparent terms allow startups to scale quickly.

What Do New Businesses Need to Qualify for a Loan?

Qualifying for a loan can seem daunting, but understanding requirements for each lender helps new businesses prepare efficiently.

For SBA or Banks:

Traditional lenders require thorough documentation to assess risk and approve loans, making the process detailed and time-consuming for startups.

- Strong personal credit (680+)

- Detailed business plan

- Collateral

- Projections & financial statements

For Lending Valley:

Lending Valley simplifies the process, focusing on minimal requirements and early revenue, so startups can secure funding quickly without unnecessary delays.

- Business bank statements (3–6 months)

- Basic revenue proof

- Business registration

- Government ID

- Simple application

We simplify the loan process so new entrepreneurs can secure funding fast, skip unnecessary delays, and focus on growing their business with confidence today!

So, Why Choose Lending Valley for New Business Funding?

1. On-Time Credit Delivery:

Lending Valley ensures funding arrives exactly as promised, typically within 24–48 hours. New business owners can rely on consistent, dependable disbursements, removing delays and allowing startups to focus on growth and operational needs immediately.

2. Transparent Terms:

All repayment terms are explained clearly, with no hidden or predatory fees. Entrepreneurs know exactly what they owe and when, creating trust, reducing uncertainty, and allowing new businesses to manage finances confidently without surprises.

3. Ideal for New Businesses:

Startups benefit from flexible credit requirements, no collateral, and no long business history. Lending Valley makes it possible for early-stage businesses to access critical capital quickly and efficiently, supporting growth from day one.

4. Relationship-Based Lending:

Every founder receives a dedicated account manager who guides them through the funding process, answering questions, assisting with documentation, and ensuring a smooth, personalized experience from application to funding delivery.

5. Trusted Nationwide:

Lending Valley has funded hundreds of startup businesses across the U.S., earning strong reviews for transparency, clarity, and honesty. Entrepreneurs nationwide rely on their proven, trustworthy approach to secure business capital.

How New Businesses Typically Use Their Startup Loans?

New businesses typically use startup loans to cover essential expenses that ensure smooth operations and growth during the critical early months. One of the primary uses is buying inventory, which allows businesses to meet customer demand without interruption and maintain consistent stock levels. Many startups also allocate funding to launch marketing campaigns, helping build brand awareness, attract customers, and generate early revenue.

Hiring staff is another major expense, as having a skilled team in place is crucial to handle operations efficiently. Leasing workspace or commercial property is often necessary for businesses that require a physical location, whether for retail, offices, or production. Startup loans are also commonly used to purchase essential equipment, machinery, or technology needed for daily operations.

Software and tools, such as accounting programs, point-of-sale systems, or project management platforms, are another important area of expenditure. Finally, startup loans help manage early cash-flow gaps, covering unexpected expenses, bridging revenue lags, or smoothing seasonal fluctuations. By strategically allocating funds, new businesses can stabilize operations, invest in growth, and set the foundation for long-term success without compromising critical activities.

Step-By-Step: How to Apply for a Small Business Loan as a New Business?

Before applying for a small business loan, it’s important to understand the full process. Knowing the key steps helps new entrepreneurs prepare documents, streamline applications, and secure funding efficiently without unnecessary delays.

1. Identify your funding need:

Determine the exact amount of capital your business requires for inventory, equipment, marketing, hiring, or operational costs. A clear funding goal helps you choose the right loan type and avoids over- or under-borrowing.

2. Prepare basic documents:

Gather essential documentation such as bank statements, revenue proof, business registration, and identification. Having all paperwork ready ensures a smoother application process and faster approval from lenders.

3. Apply with Lending Valley:

Complete the simple online application, providing revenue history and business information. Lending Valley’s streamlined system allows startups to submit requests quickly without heavy paperwork or long approval cycles.

4. Underwriting review (same day):

Lending Valley reviews your application, verifies documents, and evaluates eligibility. The same-day review ensures rapid decision-making, helping new businesses access timely funding and maintain operational momentum.

5. Approval within 24 hours:

Once approved, you receive confirmation and clear terms. Fast approval gives startups the certainty needed to plan expenses and move forward confidently without waiting weeks.

6. Receive funding in your bank account:

Funds are deposited directly into your account, allowing immediate use for inventory, payroll, marketing, or other essential startup activities. Quick access to capital supports growth and business stability.

Real Startups Funded by Lending Valley

New Clothing Boutique (Florida)

A Florida-based clothing boutique received $35,000 in funding for inventory and initial setup. Within 30 days, the store launched successfully, attracting a steady customer base. By the second month, the boutique became profitable, demonstrating how fast, transparent funding from Lending Valley can help new businesses scale and achieve early success.

New Trucking Company (Texas)

A Texas startup trucking company secured $60,000 to cover fuel, repairs, and operational costs. Within six months, the business expanded from a single truck to a fleet of three, improving logistics capacity and revenue. Lending Valley’s quick funding enabled immediate growth without the delays of traditional bank loans.

Startup Digital Agency (New York)

A New York digital agency startup received $25,000 to invest in advertising and hire staff. In just 90 days, the agency gained 12 new clients, establishing a solid revenue stream. Lending Valley’s fast, flexible funding supported rapid client acquisition and early business success for the startup.

Why New Entrepreneurs Trust Lending Valley?

Experience

Lending Valley brings over 10 years of experience funding early-stage companies, understanding startup challenges, and providing fast, reliable access to capital for businesses launching or expanding across diverse industries.

Expertise

Specializing in startup cash-flow loans and merchant cash advance programs, Lending Valley delivers tailored financial solutions that support growth, manage operational costs, and help entrepreneurs navigate early-stage funding hurdles.

Authoritativeness

Recognized and trusted by brokers, business networks, and over 1,000 small businesses nationwide, Lending Valley has built a strong reputation for providing dependable, transparent, and effective startup financing solutions.

Trustworthiness

Lending Valley offers transparent terms, no hidden surprises, on-time credit delivery, and real human support, ensuring startups can access funding confidently and focus on growth without unnecessary complications.

Proof Points:

- $50M+ funded nationwide (2024–2025)

- 24–36 hour funding turnaround

- 95% client satisfaction

SBA vs Bank vs Lending Valley for New Businesses

| Feature | SBA Loan | Bank Loan | Lending Valley |

|---|

| Approval Time | Typically takes 4–8 weeks due to government processing, underwriting, and documentation requirements, which can slow access to capital for startups. | Usually 2–6 weeks; banks require thorough reviews, credit checks, and collateral verification, making the process longer for new businesses. | Fast approvals within 24–48 hours, providing new businesses immediate access to funds to cover inventory, payroll, and operational needs. |

| Credit Score | Requires a minimum credit score of 680+; new entrepreneurs with lower scores may struggle to qualify. | Generally requires 700+ credit, limiting eligibility for early-stage startups or entrepreneurs still building credit. | Flexible credit requirements allow startups and new businesses with limited history to secure funding easily. |

| Business Age | Loans generally available for businesses 1–2 years old, focusing on slightly established operations. | Typically require 2+ years in business; startups often face rejection due to lack of track record. | New businesses and startups are eligible, making it ideal for entrepreneurs just launching their ventures. |

| Collateral | Collateral is usually required, such as equipment, real estate, or other assets, to secure the loan. | Banks almost always require collateral, limiting options for asset-light startups. | No collateral needed; Lending Valley prioritizes revenue potential and minimal documentation. |

| Documentation | Heavy documentation needed: business plans, financial statements, tax returns, and projections are mandatory. | Extensive paperwork, including credit reports, cash flow projections, and personal guarantees, is required. | Minimal documentation required: business bank statements, revenue proof, and basic ID are sufficient. |

| Transparency | Terms are moderately clear, but some fees or conditions may be hidden or require careful review. | Medium transparency; repayment schedules and fees may be complex or contain surprises. | 100% clear terms with no hidden fees, full repayment transparency, and direct support throughout the process. |

Conclusion — Start Your Business with a Funding Partner You Can Trust

New businesses need more than just capital; they require a funding partner that delivers speed, clarity, and honesty without the delays or confusion common with traditional lenders. Early-stage entrepreneurs often face hurdles like strict credit requirements, heavy documentation, and slow approvals that can stall growth before it begins. Lending Valley is built to remove these barriers, offering fast, transparent funding with minimal paperwork and flexible eligibility. By providing reliable access to capital, Lending Valley empowers startups to purchase inventory, hire staff, invest in marketing, and cover operational costs confidently.

“We help new businesses grow by providing fast, transparent, and trustworthy funding — delivered on time, every time.” Launch your business with confidence: apply today with Lending Valley and secure the capital you need quickly, easily, and stress-free.

FAQs — Small Business Loan for New Businesses

Yes, Lending Valley specializes in funding startups with minimal business history. They require only a few months of revenue or financial proof, making early-stage financing accessible.

Low personal credit is not a barrier with Lending Valley. Their flexible credit requirements allow entrepreneurs with limited or poor credit to qualify for funding.

Funding can be approved and delivered within 24–48 hours. This fast turnaround helps startups cover inventory, payroll, and operational costs immediately.

Some loans may require at least minimal revenue, but Lending Valley also offers options like MCAs and startup-friendly loans for businesses with very limited income.

Merchant cash advances and Lending Valley’s startup-friendly loans are the easiest to secure. They require minimal documentation and flexible eligibility, ideal for new businesses.

Funding ranges from $10,000 to $500,000 depending on revenue, loan type, and business needs. Lending Valley evaluates each startup individually to maximize support.

Yes, MCAs are safe when used responsibly. Lending Valley offers clear terms, flexible repayment based on sales, and transparent processes for secure, fast capital access.

The post Small Business Loans for New Businesses — Fast, Flexible, & Transparent Funding by Lending Valley appeared first on Lending Valley - Trusted Merchant Cash Advance Company.

]]>The post Best Financing Options in 2025 for Minority-, Women-, and Veteran-Owned Small Businesses in the U.S. appeared first on Lending Valley - Trusted Merchant Cash Advance Company.

]]>The good news? 2025 is a turning point.

More government programs, state-backed initiatives, and mission-driven lenders are finally stepping up to make access to capital faster, fairer, and simpler.

So grab your coffee, and let’s walk through the best financing options available right now, explained in plain English, with real examples and tips that actually matter.

🌎 The 2025 Funding Landscape at a Glance

Before diving into specifics, here’s the reality check:

- The SBA (Small Business Administration) broke records this year, with over 84,000 loans totaling nearly $45 billion going to small businesses. That’s the highest in U.S. history.

- The State Small Business Credit Initiative (SSBCI 2.0) is still rolling out across the country, turning every $1 of state funding into roughly $10 of private lending.

- CDFIs (Community Development Financial Institutions) are thriving, with $8.8 million in fresh federal support to help more local and underserved entrepreneurs access fair loans.

In short: there’s real money out there. You just need to know where to look.

Looking for a rapid and reliable Merchant Cash Advance? Get in touch today! MCA lender

💼 1. SBA 7(a) and 504 Loans — Best for Growth and Stability

If you’re looking for a classic “get it done” business loan, start here.

The SBA 7(a) and 504 programs are perfect for expanding, buying equipment, or refinancing expensive debt.

Why they’re great:

- Long repayment terms (up to 25 years).

- Interest rates that are much lower than short-term online loans.

- Easier approval when backed by the SBA guarantee.

2025 update: The SBA tweaked its fees and guidelines this year. Some veteran-owned or manufacturing businesses can even get fee waivers on certain loans.

🧠 Pro tip: Always ask your lender for the latest FY2025 fee schedule, because a few percentage points can mean thousands saved.

🏛️ 2. SSBCI 2.0 — The “Hidden Gem” State Program

You’ve probably never heard of SSBCI, but you should.

This federal-state partnership helps banks lend to small businesses that might otherwise be declined.

Think of it as a safety net: the state shares the risk with your lender, making approvals easier, especially for minority- or women-owned firms.

How to access it:

Ask your local bank or CDFI, “Are you part of your state’s SSBCI lending network?”

If they say yes, bingo. You’ve just opened a faster path to approval.

🤝 3. CDFIs — The Local Heroes of Community Lending

If you’ve ever felt brushed off by a traditional bank, a CDFI might change that story.

They’re nonprofit or mission-driven lenders built to serve underserved and underestimated founders. They care less about your credit score and more about your story, cash flow, and potential.

Real story (2025):

A small logistics company in South Texas partnered with NeighborWorks Laredo, a newly certified CDFI, to secure affordable financing and business coaching. That one partnership kept 20 local jobs alive.

If you’re rebuilding credit or just starting out, start with a CDFI before you go to a big bank.

💪 4. MBDA — Minority Business Development Agency Support

Here’s a program that deserves more attention.

The MBDA (part of the U.S. Department of Commerce) runs business centers nationwide that help minority founders become lender-ready, from refining their financials to finding investors.

In 2025, the MBDA launched $11 million in new funding to train and assist more minority entrepreneurs.

Think of them as your personal “capital coach.”

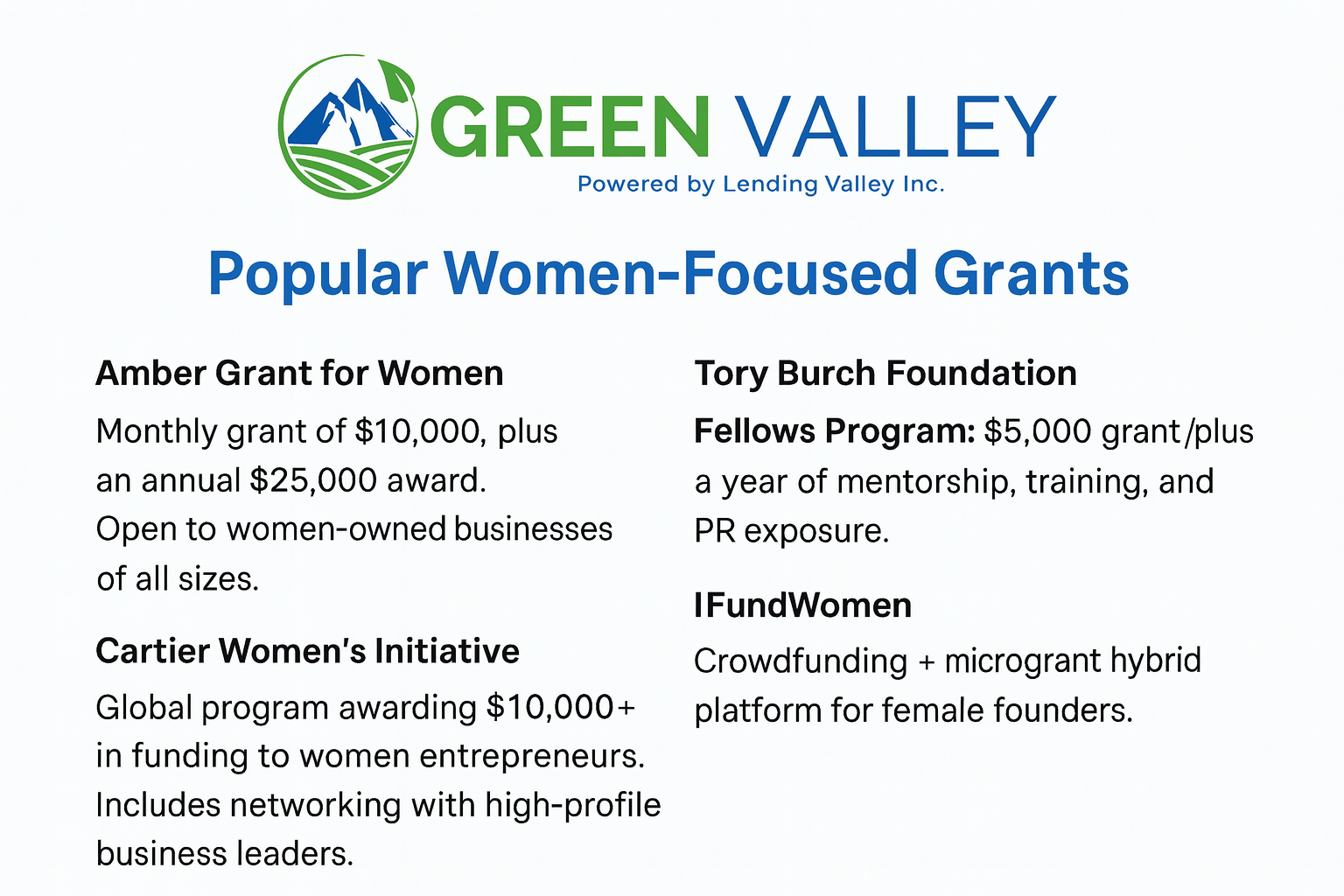

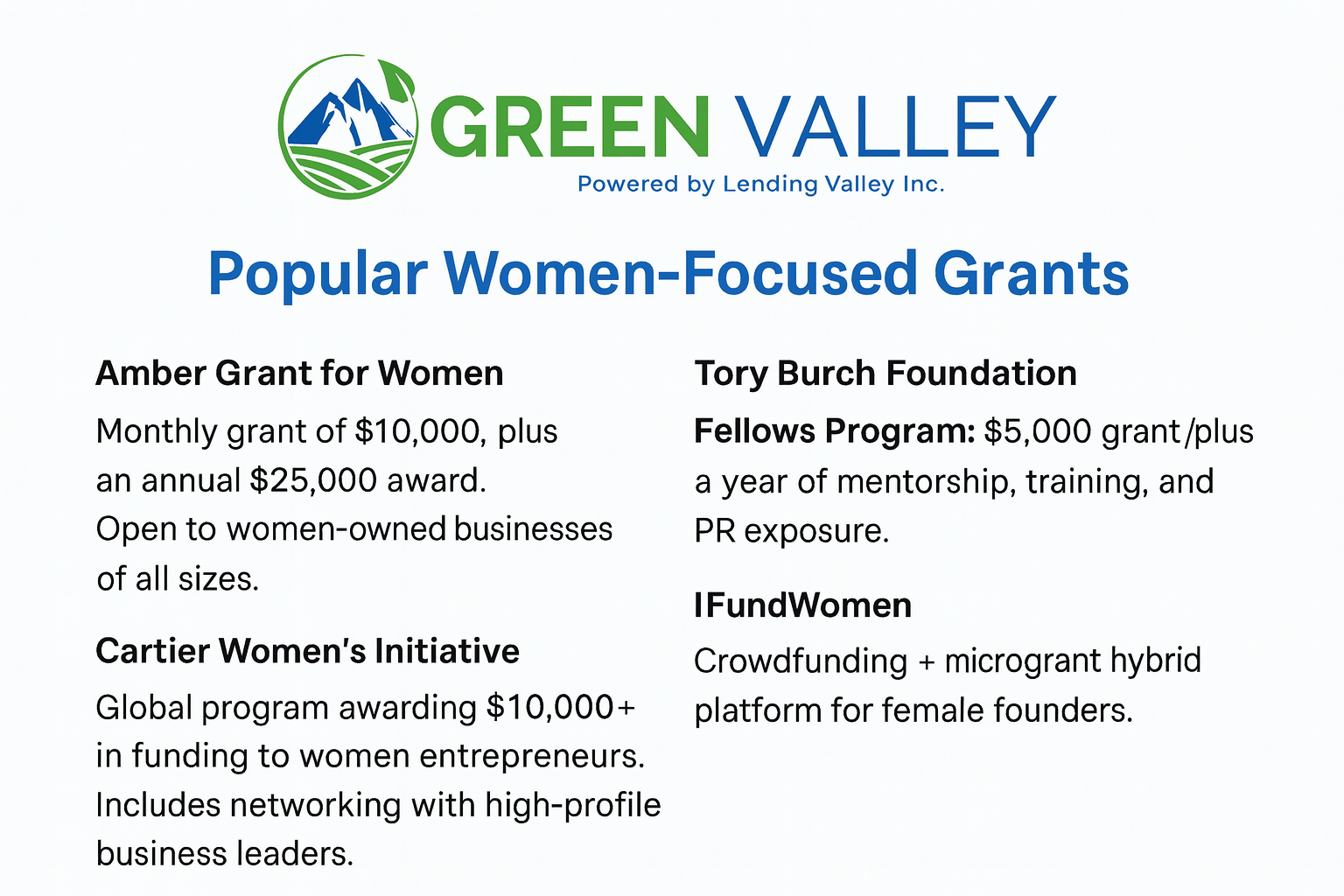

👩💼 5. Women-Owned Business Funding and Grants

Good news, ladies — 2025 has been your year.

- The WOSB (Women-Owned Small Business) certification opens the door to 5% of all federal contracting dollars.

- Private programs like BMO’s Celebrating Women Grant gave out $150,000 to women-led startups across the U.S.

- AT&T’s “She’s Connected” campaign offered cash grants and mentorship, a combo that’s priceless for scaling.

If you haven’t yet, visit the SBA’s WOSB portal and start your certification process. It takes time, but it’s worth every minute.

🎖️ 6. Veteran-Owned Business Funding

Veteran entrepreneurs, you’ve got unique advantages too.

The VetCert program centralizes certification so you can qualify for Service-Disabled or Veteran-Owned Small Business contracts.

Pair that with an SBA Express Loan (which waives certain fees for veterans), and you’ve got one of the fastest approval pipelines available in 2025.

Need help preparing your paperwork?

Reach out to a Veterans Business Outreach Center (VBOC), and they’ll walk you through it for free.

📊 Real 2025 Success Stories

- California Wildfire Relief (Women-Owned):

After the Eaton Fire, 50 women-owned businesses received $25,000 each through a partnership between 11:11 Media Impact and GoFundMe.org, a total of $1.25M in direct aid. - Texas Logistics Company (Minority-Owned):

NeighborWorks Laredo’s CDFI certification unlocked fresh capital for dozens of minority entrepreneurs in border communities. - BMO Women in Business Grant (National):

15 women-led companies each received $10,000 grants to expand their teams and launch new products in 2025.

These stories prove one thing: access to capital is finally starting to shift in the right direction.

🧩 Which Option Fits You Best?

| Business Type / Goal | Start Here | Why |

|---|---|---|

| Need low-cost, long-term capital | SBA 7(a) or 504 Loan | Lowest interest, longest term |

| Struggle with approval odds | SSBCI or CDFI | Easier approvals, more flexible |

| Women-owned startup or scaling brand | WOSB + BMO / AT&T Grants | Free grants + contracts |

| Veteran-owned business | VetCert + SBA Express | Fast approval, fee waivers |

| Minority entrepreneur seeking mentorship | MBDA Business Center | Training + lender intros |

🧠 Smart Tips Before You Apply

- Prep your documents: Banks love organized founders. Keep 3–6 months of statements and a clear business plan ready.

- Leverage your certification: WOSB, VetCert, or Minority-Owned credentials can unlock better loan terms.

- Ask about SSBCI participation: That one question can turn a “maybe” into a “yes.”

- Mix & match: Pair a small grant or SSBCI-backed loan with an SBA loan for sustainable growth.

- Don’t be shy: Local CDFIs want to lend, they just need you to start the conversation.

💬 Final Thoughts

Getting funding in 2025 doesn’t have to feel impossible.

Yes, paperwork, acronyms, and lender jargon can make anyone’s head spin. But today, there are more doors open than ever before for minority-, women-, and veteran-owned businesses.

Start local. Ask questions. And don’t settle for “we’ll get back to you.”

You’ve earned the right to get funded…now go claim it.

The post Best Financing Options in 2025 for Minority-, Women-, and Veteran-Owned Small Businesses in the U.S. appeared first on Lending Valley - Trusted Merchant Cash Advance Company.

]]>The post Understanding Truist Small Business Loans: A Comprehensive Guide appeared first on Lending Valley - Trusted Merchant Cash Advance Company.

]]>This guide breaks down Truist’s small business loans—what they are, how they work, their benefits, drawbacks, eligibility criteria, and the process to apply. Whether you’re a startup or an established business, this guide will help you determine whether Truist is the right fit for your financing needs.

Truist: Bank Overview & Business Lending Context

Who is Truist?

Truist Financial Corporation was established in December 2019 through the merger of BB&T and SunTrust Banks. Headquartered in Charlotte, North Carolina, Truist operates across 15 states and Washington, D.C., with over 1,900 branches. It offers a wide array of services including personal banking, commercial banking, wealth management, and lending solutions.

For small businesses, Truist focuses on providing accessible financing, flexible repayment options, and dedicated support. The bank’s approach combines traditional banking reliability with modern technology, helping entrepreneurs manage daily operations, scale efficiently, and stay competitive.

Types of Small Business Loans at Truist

Truist offers several financing products designed to meet different business needs and sizes.

| Loan Type / Product | Use Case | Key Highlights |

|---|---|---|

| Line of Credit (Unsecured & Secured) | Managing working capital, bridging cash flow gaps | Unsecured LOC up to $100,000 (12–36 months). Secured LOC up to $250,000 with longer terms. |

| Term Loans (Unsecured / Secured) | Expansion, equipment, or large purchases | Fixed repayment terms; unsecured loans up to $100,000. |

| SBA-Guaranteed Loans | Major expansions, real estate, or high-capital projects | Truist is an SBA-approved lender offering 7(a) and 504 loans. |

| Commercial Real Estate Loans | Purchase or refinance business properties | Loan amounts up to $250,000 or more depending on collateral. |

| Vehicle / Equipment Loans | Buying or leasing business assets | Up to $250,000; flexible repayment structures available. |

For most small businesses, Truist’s offerings are practical for managing operational costs or funding moderate growth, rather than large-scale, multimillion-dollar ventures.

What to evaluate if you’re considering a loan with Truist

Pros Pros |  Cons / Things to check Cons / Things to check |

|---|---|

| Broad range of loan types (personal, auto, HELOC, small business) | As with any large lender, terms may be less personalised than a small local bank or credit union |

| Unsecured loans often require good-to-excellent credit, so they may be less accessible for some borrowers | Unsecured loans often require good-to-excellent credit, so may be less accessible for some borrowers |

| Their small business loan products clearly state maximums, some no-origination-fee options. | Terms (rates / LTV / loan amounts) may vary by state, credit profile, branch, check locally |

| Usage of digital tools, application progress trackers for mortgages. | Borrowers should still compare rate, total cost (interest + fees) vs other lenders |

| Large institution: branch coverage, brand recognition | Large banks may have more bureaucracy or slower decision-making than smaller lenders |

Tips for evaluating and comparing Truist loans

Evaluate the financial services company Truist on its loan options

- Check your credit & income: Many of Truist’s unsecured loans (via LightStream) are geared toward strong credit profiles.

- Compare APRs & terms: Not just the interest rate, but the term length, origination fees (if any), and prepayment penalties.

- For secured loans (home, auto): Understand collateral implications (e.g., if home is used for HELOC).

- For business loans: Review the small-business loan terms (max amounts, required documentation, collateral requirements).

- Use the bank’s tools: Truist offers calculators, borrowing guides (“Borrowing for a big purchase”) to help you evaluate cost.

- State-specific & product-specific terms vary: Always check what’s available in your region (US states) and what fine print applies.

- Consider alternative lenders: Even though Truist is strong and established, you may find better terms elsewhere depending on your profile and loan type.

- Service reputation: While not always fully captured online, check reviews for branch support, digital banking ease, responsiveness.

Deep Dive: Truist’s Small Business Line of Credit

A line of credit (LOC) is among the most flexible financing tools available. Truist provides both unsecured and secured LOCs to meet different borrower profiles.

1. Unsecured Line of Credit

This product allows you to access up to $100,000 without pledging collateral. The term usually ranges between 12 and 36 months, and interest is charged only on the amount you draw, not on the total limit. It’s an ideal choice for short-term operational needs, such as payroll, vendor payments, or emergency expenses.

2. Secured Line of Credit

For larger requirements, Truist offers secured LOCs of up to $250,000. These are backed by assets such as real estate or equipment, which allows longer repayment terms and often lower interest rates. Businesses with stable cash flow and valuable collateral can leverage this to maintain liquidity without depleting reserves.

The revolving nature of both lines of credit means you can reuse the funds repeatedly once repaid—making them a reliable safety net for ongoing cash flow management.

Benefits & Strengths of Truist’s Small Business Loans

Working with Truist provides several advantages, especially if your business needs flexible, transparent lending options.

Flexibility in Use: Funds can be used for multiple purposes—purchasing inventory, covering payroll, managing seasonal fluctuations, or funding short-term projects—without strict restrictions.

Revolving Access with LOCs: Once approved, your credit line remains available for the term period, and you can borrow and repay as needed without reapplying.

Interest Efficiency: You pay interest only on the portion you draw, helping reduce unnecessary financing costs.

Collateral Options: Businesses with valuable assets can leverage them for higher borrowing limits and better rates, while those without collateral can opt for unsecured products.

SBA Integration: As an SBA-approved lender, Truist provides access to government-backed loans with competitive terms, lower down payments, and partial guarantees.

No Prepayment Penalty: Truist allows early repayment without penalties, giving borrowers the freedom to manage debt responsibly.

Convenient Application Process: Applications can be submitted online, by phone, or at a local branch, with responsive customer support and clear guidance at every step.

Risks, Downsides & Limitations: Despite its advantages, Truist’s small business loans have a few limitations worth noting.

Lower Maximum Amounts for Smaller Businesses: While suitable for modest funding needs, Truist’s standard small business loan limits (often $250,000 or less) may not be enough for large-scale expansions.

Strict Underwriting for Newer Businesses: Startups or companies with less than two years in operation might face stricter evaluation or be eligible for smaller amounts.

Variable Interest Rates: Some lines of credit have variable rates, which can increase with market fluctuations.

Collateral and Personal Guarantees: Secured loans require collateral, and unsecured ones may still require a personal guarantee, putting your personal assets at risk if repayment fails.

Fees and Inactivity Charges: Truist may charge origination fees, maintenance costs, or inactivity penalties. Businesses should review all terms carefully before signing.

Geographical Limitation: Only businesses operating within states where Truist has branches or services are eligible.

Documentation Burden: For higher loan amounts or SBA products, detailed documentation—like financial statements, tax returns, and collateral appraisals—is required.

Who Qualifies & Underwriting Criteria?

Truist evaluates multiple factors before approving business loans:

- Time in Business: Usually one to two years of operation.

- Revenue & Cash Flow: Steady income to ensure repayment ability.

- Creditworthiness: Strong business and personal credit profiles are vital.

- Debt Load: A manageable debt-to-income ratio is essential.

- Financial Documentation: Includes tax returns, balance sheets, and cash flow reports.

- Collateral: Required for secured or larger loans.

- Business Location: Must fall within Truist’s operational states.

Businesses with strong revenue, positive cash flow, and good credit can often negotiate better rates and terms.

Imagine a small retail store in North Carolina experiencing seasonal cash flow gaps before the holiday season. The owner secures an unsecured line of credit worth $80,000 from Truist. In October, they draw $40,000 to stock new merchandise. By December, after strong holiday sales, they repay the amount plus interest. The credit line resets, ready for future needs like marketing or renovations.

This kind of flexible borrowing allows small businesses to stay agile and financially stable without long-term debt burdens.

How to Apply: Step-by-Step Guide

1. Prequalification and Assessment: Determine your funding needs and ensure your business operates in a Truist-serviced state.

2. Gather Documentation: Prepare business tax returns, financial statements, and bank statements. Include personal financials if needed.

3. Submit Application: You can apply online, by phone, or at a Truist branch. SBA loans may require coordination with an SBA lending officer.

4. Underwriting and Approval: Truist reviews your creditworthiness, cash flow, and overall financial health. They may request additional details or collateral information.

5. Closing and Funding: Once approved, you’ll sign loan documents and receive funds either as a lump sum (for term loans) or revolving access (for LOCs).

6. Repayment and Renewal: Make timely payments as per the schedule. Before the term ends, Truist may reevaluate your business for renewal or adjustment.

Frequently Asked Questions: Truist Small Business Loans 2025

1. What credit score is needed for a Truist small business loan?

A good credit score—typically 680 or higher—improves your approval chances and helps you qualify for better rates. Truist may also consider your business credit score and cash flow stability when reviewing your application.

2. Can startups apply for Truist business loans?

Yes, but funding options for startups are usually limited. Startups with strong personal credit and solid business plans may qualify for smaller unsecured loans or SBA-backed programs.

3. What’s the difference between a Truist term loan and a line of credit?

A term loan provides a fixed amount for specific purposes and requires regular monthly payments. A line of credit, on the other hand, offers revolving access to funds that can be reused after repayment.

4. Are there prepayment penalties?

Most Truist small business loans do not carry prepayment penalties. You can repay early to reduce interest costs without worrying about additional fees.

5. How long does the approval process take?

For smaller loans or lines of credit, approvals may take a few business days. Larger or SBA-backed loans might require additional documentation and take longer for underwriting.

Key Takeaways and Conclusion

Truist offers small business loans and lines of credit designed to help businesses manage growth, maintain cash flow, and cover operational expenses. Their flexible options, SBA partnerships, and user-friendly process make them an appealing choice for many small business owners.

However, as with any financing option, it’s crucial to assess your repayment capacity and loan purpose carefully. Prepare financial documents, maintain a strong credit profile, and apply strategically to maximize approval chances.

Key Points to Remember:

- Truist provides both secured and unsecured small business financing options.

- Its SBA partnerships offer competitive rates and favorable repayment terms.

- Flexible credit lines can help bridge short-term cash flow gaps efficiently.

- Maintaining good credit and stable revenue improves loan terms and limits.

- Businesses must operate in states where Truist is licensed to lend.

When used wisely, Truist small business loans can be a reliable financial tool to stabilize your operations, strengthen cash flow, and support your long-term growth strategy.

The post Understanding Truist Small Business Loans: A Comprehensive Guide appeared first on Lending Valley - Trusted Merchant Cash Advance Company.

]]>The post Women Small Business Loans FAQs: What Every Female Entrepreneur Should Know appeared first on Lending Valley - Trusted Merchant Cash Advance Company.

]]>1. Are there business loans designed specifically for women entrepreneurs?

Yes. While most business loans are “gender-neutral” (meaning any qualified applicant may apply), there are several programs, nonprofits, and initiatives that are specifically focused on women entrepreneurs or offer favorable support for them. Examples:

- The Small Business Administration (SBA) supports women with counseling, special resource networks, and by tracking women-owned business lending.

- Nonprofits & microfinance institutions (e.g. Opportunity Fund, Accion) often provide capital—or better terms—for women, especially underserved borrowers.

- Women’s Business Centers (funded by the SBA) offer assistance and sometimes help connect you to lenders or capital that favor women entrepreneurs.

- Grant programs & competitions exist exclusively for women (though note: grants are not loans).

- It’s rare to find a mainstream bank that openly advertises a “women-only loan”. The real difference often lies in outreach, reduced barriers, and resource/mentorship support rather than strict exclusivity.

2. What eligibility criteria do lenders use (credit score, time in business, revenue) to approve business loans for women?

Lenders typically use the same fundamentals for all business borrowers. For women, meeting or surpassing these criteria strengthens your application. Here are key factors and typical ranges:

| Factor | Typical Requirement / Range | Why It Matters |

|---|---|---|

| Credit score | Often 640+, sometimes lower for alternative lenders | Reflects creditworthiness |

| Time in business / track record | Often 6 months to 2+ years | Demonstrates stability |

| Revenue / cash flow | Enough steady income to cover debt payments | Ability to repay loan |

| Collateral / assets | Property, inventory, receivables, equipment | Mitigates lender risk |

| Personal guarantee | Often required | Puts more skin in the game for lender security |

| Debt service coverage ratio | ≥ ~1.2x (income vs obligations) | Ensures debt can be serviced |

| Business financials & documentation | Income statements, balance sheets, tax returns | Validates business health |

| SBA size & eligibility criteria | Business must be “small” per SBA, for-profit, etc. | Required for SBA-backed loans |

Note: Women may also face perception bias in practice, but formally the criteria are the same. Good preparation helps overcome extra hurdles.

3. Can I get a startup business loan as a woman with no prior revenue or operating history?

Yes—but it’s more challenging. Several avenues make it possible if you have strong preparation:

- Microloans / community lenders: Nonprofit or local programs that lend smaller amounts, often with mentoring or guidance.

- Alternative / online lenders: More flexible but usually higher interest rates or stricter terms.

- Personal / business lines of credit based on your personal credit history or assets.

- SBA microloans: Up to around $50,000 in some cases. (Requires other strengths: clear business plan, etc.)

- Peer-to-peer platforms, crowdfunding, pitch competitions: These may let you access capital even without revenue, but you’ll need a very strong business model or proof of future demand.

If you’re brand-new: prepare a strong plan, gather collateral if possible, use a co-signer/guarantor if needed, and show your seriousness through well-organized documentation.

4. What is the minimum credit score needed to qualify for an SBA loan (or other typical business loans)?

There’s no fixed universal number—it depends on many factors. But here are benchmarks and what lenders often require:

- For SBA-guaranteed loans: many lenders prefer credit scores in the 650-700+ range. Weaker scores might still work if other parts of the application are strong.

- Alternative / online lenders: some accept scores in the 600-640 or even 580+ range, though expect higher interest rates or more fees.

- Microloan programs: often more flexible, particularly for women or underserved borrowers.

- Other aspects like cash flow, collateral, business plan can compensate if your credit isn’t near ideal.

5. Do I need collateral or a personal guarantee to secure a business loan?

Often yes, especially for larger loans or when the risk profile is higher. Key points:

- Collateral is typically required for bigger amounts (real estate, equipment, inventory).

- Personal guarantees are common, especially when business credit history is limited. Even with LLCs or corporations, lenders may require you to personally guarantee.

- Some microloans or smaller amounts may waive collateral under certain conditions.

- SBA 7(a) and 504 loans: lenders are expected to pursue collateral when available; specifics vary.

If you lack assets, consider smaller-scale loans, nonprofits, or more flexible lenders.

6. What kinds of business loan programs are available (SBA 7(a), microloans, lines of credit, equipment financing, etc.)?

Here are common programs and how women entrepreneurs often use them:

| Loan Type / Program | Purpose / Use Cases | Pros & Cons |

|---|---|---|

| SBA 7(a) | Working capital, expansion, refinancing, general use | Pros: good terms; cons: rigorous underwriting |

| SBA 504 | Long-term asset acquisition (real estate, heavy equipment) | Lower rates; but limited to certain business sizes |

| SBA Microloans | Inventory, equipment, small working capital for new or small businesses | Easier qualification; smaller amounts; possibly higher effective costs |

| Term Loans | Specific projects / expansion | Fixed schedule; usually collateral required |

| Business Line of Credit | Flexible cash flow needs | Pay interest only on amount used; variable rates |

| Equipment Financing / Leasing | Buying or leasing machinery or equipment | The asset serves as collateral |

| Invoice / Accounts Receivable Financing | Get funds against unpaid invoices | Helps cash flow; sometimes expensive |

| Merchant Cash Advances / Revenue-Based Financing | Repayment tied to a percentage of sales | Very fast access; high cost/risk |

| Community / Nonprofit Loans / CDFIs / Microlenders | Especially for underrepresented borrowers | More favorable terms; support & mentoring often included |

Women should explore SBA-backed options first, where possible, then supplement with flexible programs as needed, especially early on.

7. How do I choose the best lender (bank, online, credit union) as a woman business owner?

Here are steps & criteria to help you pick smartly:

- Understand your needs

- How much you need, how fast, for what purpose.

- Long-term vs short-term capital.

- Compare total cost

- Interest rate + all fees (origination, closing, prepayment).

- Effective APR more telling than advertised rate.

- Assess flexibility & terms

- Covenants, repayment schedule, collateral, personal guarantee.

- Ability to negotiate.

- Evaluate support & relationships

- Does the lender offer mentoring, networking, women-focused support?

- Check eligibility and rigidity

- Traditional banks often stricter; online lenders more flexible but costlier.

- Reputation & transparency

- Reviews, clarity of terms.

- Use matchmaking tools

- E.g. SBA Lender Match (for US context) or women entrepreneur network referrals.

8. What interest rates and fees are typical for small business loans for women?

Rates & fees vary widely. Here are ballpark ranges and what to watch:

- SBA 7(a) loans: usually among the lower rates — often prime + 2.75% to prime + 4.75% (depending on term, guarantee portion).

- SBA 504: competitive, especially for fixed asset loans.

- Microloans/community lenders: moderate to high, maybe in the 6%-12% range (or more if risk is high).

- Online / alternative lenders / fintech: rates often higher; fees (origination, servicing, etc.) can add up.

- Lines of credit: variable rates; expect interest + fees.

Fees to watch for:

- Origination / application fees

- Closing costs

- Prepayment penalties

- Late payment fees

- Other hidden costs (e.g., servicing, insurance, reporting)

Make sure to ask for the APR or all-in cost to compare effectively.

9. How long will it take to get approved and receive funds?

Approval and funding timelines depend on many things. Here are typical ranges:

- Online / fintech lenders: 1-3 days (sometimes same day) if you have documentation ready.

- Community / nonprofit / microlenders: about 1-2 weeks.

- Traditional banks / SBA loans: several weeks to a few months (30-60 days or more) — depending on underwriting, collateral appraisals, guarantee approvals, etc.

To speed things up: have all documents clean and organized; prepare business plan, financial statements, projections; know what lender expects.

10. How much can I borrow (loan limits) for various loan types available to women-owned businesses?

Borrowing limits vary by program; what matters most is your ability to repay. Approximate ranges:

- SBA 7(a): up to ~$5 million in many cases (though many borrowers take much less).

- SBA Microloans: up to ~$50,000.

- SBA 504: often millions depending on project size.

- Term loans / online lenders: from a few thousand to hundreds of thousands of dollars.

- Lines of credit: often capped by receivables, business size, collateral; could range from $10,000 to several hundred thousand.

- Equipment financing: often up to 100% of the equipment cost (or close to it).

- Community/nonprofit lenders: usually smaller limits (tens of thousands).

11. Are there grants or non-repayable funds available exclusively for women entrepreneurs (vs. loans)?

Yes. These are attractive because you don’t repay them—but they are competitive and limited. Key points:

- Many nonprofits, corporate foundations, government agencies run grants/pitch competitions for women entrepreneurs.

- Some business incubators or accelerator programs award seed grants or do funding awards specifically for female founders.

- Local/state economic development agencies often have programs aimed at women-owned businesses.

Caveats:

- Amounts may be small.

- Strong competition.

- Reporting or deliverables may be required.

- Usually not enough to replace a loan if you need large capital—but helpful for startup costs/investment.

12. How does business structure (sole proprietor, LLC, corporation) affect my ability to borrow?

Business structure can matter in several ways:

- Liability & Risk: LLCs / corporations separate business liability, which lenders may prefer.

- Credit Profile: Entities with their own EIN that have history can build business credit.

- Tax & Financial Reporting: Corporations often have more formal required reporting; helps if organized.

- Ownership & Control: Lenders often look for clear ownership structure; being majority woman-owned (51%+) may matter for eligibility for certain programs.

- SBA / program specific rules: Some loan or grant programs require you to be a for-profit business, have certain structure, etc.

13. Do I have to personally guarantee the loan or use my personal credit/history?

Yes, in many cases:

- Personal guarantee is commonly required, especially when business has limited credit history.

- Lenders will likely check your personal credit even if business is a separate entity.

- Guarantees mean you’re personally responsible if business can’t pay.

- Over time, once business has strong independent credit, you might negotiate this away—but early on, often necessary.

14. Will taking out a loan as a woman hurt my personal credit score?

Possibly—but only under certain circumstances:

- If you personally guarantee the loan, and payments are reported to credit bureaus, then missed/late payments impact personal credit.

- Even obtaining a loan or credit line may trigger a hard inquiry, which can temporarily lower your credit score.

- If business is structured separately and credit is held in business name, effects can be less—but lenders often still check personal credit.

Responsible repayment generally supports good credit; keeping up with terms is essential.

15. What documents will lenders ask for (financial statements, tax returns, business plan)?

Typical documents include:

- Personal & business tax returns (last 2-3 years)

- Profit & Loss (P&L) statements & balance sheets

- Cash flow projections / forecasts

- Bank statements (business & sometimes personal)

- Business plan / executive summary

- Legal documents: business licenses, registration, ownership info

- Articles of incorporation / entity formation documents

- Collateral documentation (appraisals, titles)

- Personal financial statement (assets, liabilities)

Preparing these in advance and in an organized way speeds up approval.

16. Can I refinance or consolidate business debt later?

Yes. Many business owners do this to lower costs or simplify repayments.

- Refinancing might help if interest rates have dropped or your credit/business strength has improved.

- Consolidation allows merging multiple debts into one payment (potentially lower overall interest).

- Must check for prepayment penalties or closing costs.

- Lender must agree; business must still meet eligibility.

17. What happens if I default — risks, penalties, and recourse?

Consequences can be serious. Key risks:

- Negative credit impact: both business and personal (if guaranteed)

- Lender may enforce personal guarantee

- Seizure of collateral pledged

- Legal judgments, possibly lawsuits

- Bankruptcy or business closure

- Damage to reputation & future lending ability

To avoid default: maintain accurate financial records, build contingencies, communicate with lender early, renegotiate terms if needed.

18. Are there government or nonprofit lenders that prioritize women or underserved business owners?

Yes. These lenders often offer more favorable terms and support:

- Community Development Financial Institutions (CDFIs), microlenders, nonprofits focused on underserved entrepreneurs.

- Organizations like Opportunity Fund, Accion, local NGOs.

- SBA’s Women’s Business Centers & other women-focused agencies.

These can be more flexible, offer mentoring, networking, and sometimes lower cost or special eligibility.

19. How do I demonstrate that my business is viable or low risk (cash flow projections, collateral, etc.)?

Ways to show viability:

- Strong, realistic cash flow projections; show buffer for lean periods

- Historical financial performance where possible

- Diverse and recurring revenue sources

- Good credit history (business & personal)

- Collateral or pledged assets

- Solid business plan & market research

- Clear ownership, management experience

- Contracts, purchase orders or evidence of demand

- Keeping debt reasonable; showing you understand risk & mitigation

20. Is there gender bias in lending decisions, and what protections exist (laws/regulations)?

Yes, bias exists in practice; protections are also in place:

- Studies suggest women sometimes get fewer funds, stricter terms, or higher rates even when business metrics are similar.

- Laws such as the Equal Credit Opportunity Act (ECOA) in the U.S. forbid discrimination based on sex, marital status, etc.

- Agencies and nonprofits monitor and push for transparency.

- Using programs like SBA-backed loans or women’s certification programs can help.

- Keep records of lending offers, terms, and treatment. If discrimination is suspected, you may file complaints with regulatory bodies.

21. Under what circumstances will a lender require me to bring in a co-applicant or co-signer?

Commonly when:

- Business credit or cash flow is weak

- Personal credit is borderline or low

- Collateral is insufficient

- Risk is seen as high (startup, volatile industry)

- Loan amount is large relative to business size

Remember: a co-signer/co-applicant carries responsibility; defaults affect both parties.

22. Can I use the loan for any business purpose (working capital, inventory, marketing, expansion)?

Generally yes—but dependent on loan type:

- SBA 7(a): very flexible (working capital, inventory, equipment, expansion, refinancing)

- Microloans: usually flexible, but often not for purchasing real estate or debt refinancing

- Term loans/lines of credit: check the agreement; sometimes covenants limit certain uses

- Equipment financing: restricted to equipment or machinery use

- Always verify permitted uses in your loan agreement; violations can lead to default

23. How often do women small business loans applications get rejected compared to men, and why?

Evidence suggests:

- Higher rejection rates or less favorable terms for women, even when credentials metrics are similar

- Reasons include smaller collateral, weaker network access, stricter expectations or perceived risk

- Sometimes lack of advice, weaker or missing documentation contributes

To counter this: prepare strong proposals, seek multiple offers, use women-focused resources and networks.

24. After receiving a loan, what reporting or compliance obligations do I have?

Typical obligations:

- Timely repayment, meeting covenants in the loan agreement

- Periodic financial reporting (quarterly/annual) — P&L, balance sheet, cash flow

- Use of funds compliance: using money for what was agreed

- Insurance or maintenance of collateral if applicable

- Permits, licenses & legal compliance

- Disclosure of major changes (ownership, management, financial condition)

Failing to comply may lead to penalties or default.

25. What alternatives exist if I can’t qualify for a traditional women small business loans (microloans, peer-to-peer lending, revenue-based financing)?

Alternatives include:

- Microloans / nonprofits / CDFIs

- Peer-to-peer lending / online marketplace lenders

- Invoice factoring / accounts receivable financing

- Merchant cash advances / revenue-based financing

- Crowdfunding, pitch competitions

- Angel investors or venture capital (though that involves equity, not repayment debt)

- Grants or non-repayable funds, where available

- Bootstrapping, friends & family, vendor credit

26. Where can I find mentorship or training programs to help me prepare for applying (especially for women)?

Resources include:

- SBA Women’s Business Centers (in the U.S.)

- Local business associations / chambers of commerce

- Women entrepreneur networks / associations (national & local)

- Nonprofit & community organizations offering training, mentorship, finance education

- Online course /webinars on business planning & financial literacy

- Foundations / corporations that run programs for women founders

27. Can I access special federal or state programs for women-owned businesses, or preferential terms?

Yes. These programs often include:

- State/local women business development programs, revolving loan funds

- Certification as women-owned business (51%+ ownership) may unlock preferential treatment or contracting opportunities

- Special funds from government, NGOs, or corporate programs aimed at women or underrepresented business owners

- Linked deposit or subsidized interest rate programs in some states or countries

Check your country / state / city’s business agencies, women entrepreneur networks, and government small business programs for what’s available locally.

Conclusion

Securing a business loan as a woman involves understanding the criteria, knowing the program types, preparing documentation, and choosing the right lender. Use the Women Small Business Loans FAQs above as a roadmap: compare offers, explore alternatives, and lean on resources designed to support you. Being well-prepared makes a big difference.

The post Women Small Business Loans FAQs: What Every Female Entrepreneur Should Know appeared first on Lending Valley - Trusted Merchant Cash Advance Company.

]]>The post What’s the Difference Between an SBA 7(a) Loan and an SBA 504 Loan? appeared first on Lending Valley - Trusted Merchant Cash Advance Company.

]]>Let’s break it down clearly so you can decide which SBA loan fits your business needs.

Use of Funds: Flexibility vs. Focus

The most fundamental difference between these SBA loans is how you can use the money.

- SBA 7(a) Loan: The 7(a) program is known for its flexibility. You can use it for almost any business purpose — from working capital and inventory to refinancing debt, purchasing another business, or buying real estate. This makes it a versatile option for entrepreneurs who need financial breathing room or want to expand operations quickly.

- SBA 504 Loan: The 504 program, on the other hand, is designed specifically for major fixed assets. You can use it to buy or renovate commercial real estate, construct new buildings, or purchase heavy machinery and long-term equipment. What you can’t do is use it for working capital, refinancing, or inventory.

In short, go with 7(a) if you want general-purpose flexibility. Go with 504 if your goal is long-term investment in property or equipment.

Loan Structure: One Lender vs. Two

Here’s where things get structurally interesting.

- SBA 7(a) is a single loan between you and one lender, usually a bank. The SBA simply guarantees a portion of that loan to reduce the lender’s risk.

- SBA 504 loans come from two sources — a bank (or private lender) that funds 50% of the project and a Certified Development Company (CDC) backed by the SBA that funds 40%. The remaining 10% comes from you as the down payment.

While the 504 structure is a bit more complex, it allows businesses to fund larger projects with less personal risk. In contrast, 7(a) loans are simpler to manage since you only deal with one lender.

Loan Size and Project Scale

Both programs can fund millions, but the 504 loan has the edge for large-scale projects.

- 7(a): Up to $5 million maximum.

- 504: The SBA/CDC portion is also capped at $5–5.5 million, but since there’s also a bank contribution, your total project size can easily exceed $10–20 million.

For example, if you need $8 million to purchase a manufacturing facility, a 7(a) loan won’t cut it — but a 504 loan can.

Interest Rates: Stability vs. Variability

Interest rate structure is another major deciding factor between SBA 7a vs SBA 504.

- 7(a) loans typically have variable interest rates tied to the Prime rate. This means your payments could fluctuate as market conditions change. While some fixed-rate 7(a) loans exist, they’re less common for long terms.

- 504 loans usually come with a fixed interest rate (on the SBA portion) for the life of the loan. The bank portion can also be fixed or variable, but many lenders offer fixed-rate options for stability.

If you prefer predictable monthly payments, the 504 loan is ideal. But if you want shorter-term flexibility and can handle rate changes, the 7(a) might make sense.

Collateral and Guarantees

Both loans require personal guarantees, but the type of collateral they require differs.

- 7(a): Lenders typically seek collateral equal to the loan amount whenever possible. This might include business assets and even personal real estate to secure the loan.

- 504: Usually secured only by the asset being financed — such as the property or equipment you’re buying. You typically don’t need to pledge additional collateral like your home.

So, if you want to limit personal collateral exposure, the 504 loan offers a gentler approach.

Down Payment: Predictable but Slightly Different

Both programs require you to put in some of your own money, but the requirements are more standardized for 504 loans.

- 7(a): Typically requires around 10% down, though this can vary based on your credit, the lender’s policies, or the deal’s perceived risk.

- 504: Has a fixed 10% down payment, but it can go up to 15% for new businesses or specialized properties.

The 504 program’s structure can make planning easier since the down payment is consistent and set by SBA rules.

Fees and Costs

Fees are part of every loan, but the difference in structure can affect how much you pay.

- 7(a): Comes with a guaranty fee that increases with the loan amount. For larger loans (above $1 million), the fees can become quite significant.

- 504: Usually has lower SBA fees, especially for large projects, making it more cost-effective for multi-million-dollar real estate or equipment investments.

Additionally, the interest rate advantage of the 504 loan often leads to lower total financing costs over time. For smaller loans, however, the fee difference is less noticeable.

Application Process and Paperwork

The SBA 7(a) loan process is simpler since you deal with one lender. Documentation and approval times can still be lengthy, but the communication flow is straightforward.

For the SBA 504 loan, you’ll coordinate between a bank and a CDC, which adds an extra layer of paperwork and review. However, experienced lenders often streamline this process, so the delay isn’t significant for most borrowers.

Repayment Terms of SBA 7a vs SBA 504

Both loans offer long repayment periods, making them easier on cash flow:

- 7(a): Up to 25 years for real estate and 10 years for working capital or equipment.

- 504: 10, 20, or 25 years depending on the project type.

The 504 program’s fixed rates over long terms make it particularly appealing for businesses focused on long-term asset stability.

SBA 7a vs SBA 504: When to Choose Which Loan?

If you’re still torn between the two, here’s a quick summary to guide your choice:

| Factor | SBA 7(a) Loan | SBA 504 Loan |

|---|---|---|

| Best For | General business use | Real estate or equipment |

| Loan Amount | Up to $5M | Up to $20M+ (combined) |

| Structure | Single lender | Bank + CDC + You |

| Interest Rate | Usually variable | Usually fixed |

| Collateral | Business + personal assets | Financed asset only |

| Down Payment | ~10% (varies) | Fixed 10–15% |

| Processing | Faster, simpler | Slightly complex |

| Fee Structure | Higher for big loans | Lower for large projects |

Example Scenarios

- Expanding a retail store: If you need to buy inventory, hire staff, and expand your operations, a 7(a) loan gives you the freedom to use funds wherever your business needs them most.

- Buying a commercial building: If you’re purchasing an office, warehouse, or production facility, a 504 loan is tailor-made for that. It gives you a low, fixed rate and long-term stability without requiring extra collateral.

- Purchasing heavy machinery: When you’re investing in high-cost equipment that will serve your business for years, the 504 program offers ideal terms with lower rates and predictable payments.

If you are in the professional services sector, you likely need working capital more than a building; check out our guide on SBA Loans for Tax practices to see why the 7(a) is your best fit.

Can You Use Both?

Absolutely. Some businesses combine 7(a) and 504 loans strategically. For example, you might use a 504 loan to buy your property and a 7(a) loan for working capital or renovations. This hybrid approach ensures both flexibility and long-term security.

Final Thoughts

Both SBA 7(a) and 504 loans are powerful financing tools, but their strengths depend on your goals.

- Choose SBA 7(a) if you need a versatile, all-purpose loan for everyday business operations, refinancing, or acquisitions.

- Choose SBA 504 if you’re making a long-term investment in real estate or equipment and want the comfort of a fixed rate with minimal personal collateral.

In some cases, the right answer might be a mix of both. Before applying, consult a trusted SBA-approved lender who can assess your financial goals and recommend the structure that maximizes your growth potential.

FAQs About SBA 7a vs SBA 504

Which SBA loan is easier to get — 7(a) or 504?

The SBA 7(a) loan is generally easier and faster to get because it involves only one lender — typically your bank — instead of two parties like in the 504 program. Lenders also have more flexibility in approving 7(a) applications. However, qualifying for either still depends on your credit history, business financials, and repayment ability.

Can I use an SBA 504 loan to buy an existing business?

No, you can’t. The SBA 504 loan is strictly for purchasing or improving fixed assets like real estate, heavy machinery, or long-term equipment. If your goal is to buy an existing business, you’ll need to go for the SBA 7(a) loan, which allows funds for acquisitions and general business expansion.

Are SBA 504 loans only for large businesses?

Not at all. SBA 504 loans are meant for small to mid-sized businesses that need to purchase or improve facilities and equipment. Many local companies use 504 loans to buy office buildings, warehouses, or specialized machinery. The program’s structure simply makes it better suited for big, long-term investments.

Do both loans require a personal guarantee?

Yes, both SBA 7(a) and 504 loans require personal guarantees from owners who hold at least 20% of the business. This ensures the borrower’s commitment to repayment. While 7(a) loans may also require personal collateral like real estate, 504 loans are usually secured only by the asset being financed.

Can I refinance debt with an SBA 504 loan?

In most cases, no — 504 loans are not meant for refinancing standard business debt. They’re focused on property and equipment purchases. However, the SBA does allow limited refinancing under the 504 program if the debt originally financed eligible fixed assets and meets certain conditions. For most general refinancing, the 7(a) loan is the better option.

Which loan offers lower overall costs in the long run?

It depends on the project type. For large real estate or equipment projects, 504 loans often end up cheaper due to lower interest rates and smaller SBA fees. For smaller, short-term financing needs, 7(a) loans might make more sense despite higher rates. The best choice depends on how you plan to use the funds and your repayment timeline.

The post What’s the Difference Between an SBA 7(a) Loan and an SBA 504 Loan? appeared first on Lending Valley - Trusted Merchant Cash Advance Company.

]]>The post Merchant Cash Advance Attorney Guide (2025): Protect Your Business, Cut Costs, Win Better Terms appeared first on Lending Valley - Trusted Merchant Cash Advance Company.

]]>Learn in detail about Short Term Loan Quick Ways

Here’s the quick rundown:

• What an MCA is: A merchant cash advance isn’t a loan; it’s a sale of future receivables, and that difference changes everything legally.

• Why it’s risky: Many contracts include hidden traps like daily debits, factor rates, and personal guarantees that hit harder than bank loans.

• How an attorney helps: From freezing COJs to removing UCC liens or negotiating settlements, MCA lawyers fight back against unfair terms.

So, if you want to get legal clarity now to protect your business and stop unfair MCA practices before they escalate, make sure that you read this blog till the end! Let’s get started!

What is a Merchant Cash Advance Attorney (Legally) — and Why Attorneys Get Involved

A merchant cash advance isn’t a traditional loan. Legally, it’s an advance on your future receivables, meaning the lender buys a portion of your upcoming credit card or bank deposits at a discounted rate. Instead of interest, contracts use a factor rate, and repayments are collected through daily or weekly holdbacks via ACH. This structure can make the cost of capital feel deceptively high, especially for small businesses.

Attorneys often get involved because MCAs include clauses that carry significant legal risk. Personal guarantees can hold you personally liable if the business defaults. Blanket UCC-1 liens can allow funders to seize assets quickly, and in some states, confessions of judgment (COJs) give lenders the ability to obtain a judgment without trial. Understanding these provisions is crucial as counsel helps evaluate enforceability, spot defects, and develop defenses before the contract creates serious problems.

For Example:

A small retail store took a $50,000 MCA to cover holiday inventory. Daily debits quickly strained cash flow, and a UCC lien on their equipment gave the lender leverage to demand immediate payment. With attorney guidance, the business negotiated a temporary holdback reduction and a lien release plan, avoiding default while keeping operations running.

2025 Landscape: Rules, Risks, and Headlines