Our goal at Lending Valley is to provide all small business owners access to the best loans possible for their business. You can rest assured we will get you the best rates in the market!

Choosing the right funding partner can speed up your growth or squeeze your margins. Let’s compare Merchant Cash Advances (MCAs) against traditional business loans so you can decide fast, with facts.

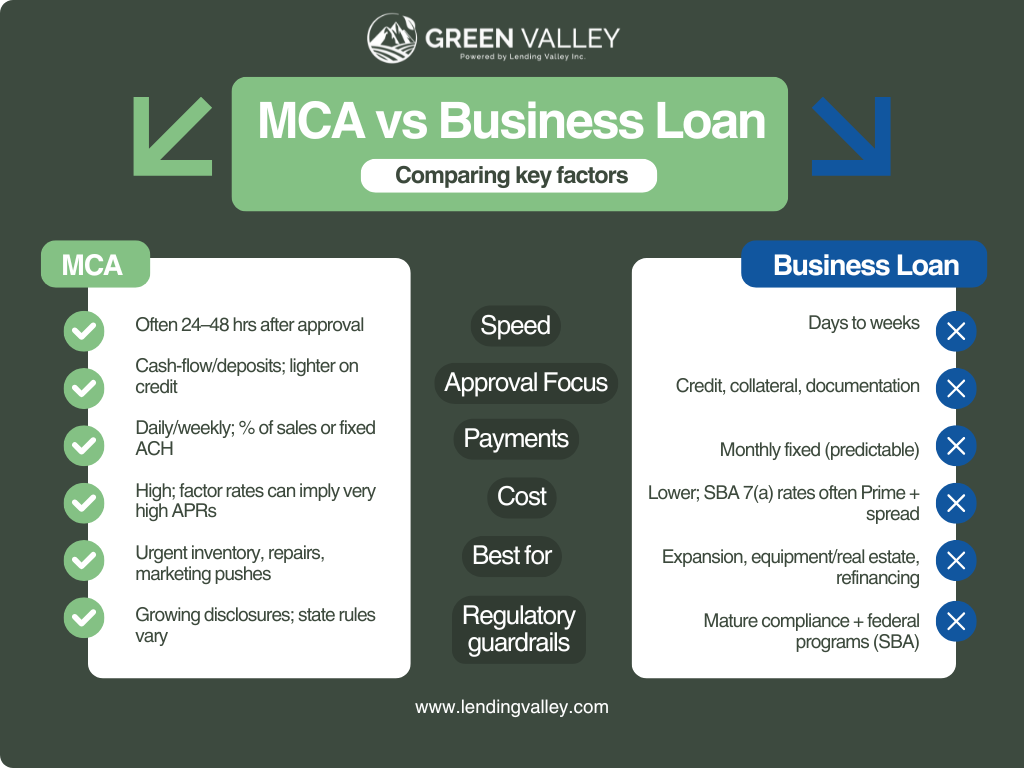

MCA (sales-based financing). You get a lump sum today in exchange for a share of future sales, or a fixed daily/weekly ACH. It’s not a loan, so underwriting leans on cash flow, not just credit. Funding is fast, but the total cost can be high.

Business loan (bank/SBA/online). You borrow at an interest rate, repay in fixed installments over months or years. Approval takes longer, but APR is typically lower than an MCA. The SBA 7(a) program is the flagship option for many small firms. sba.gov

| Factor | MCA (Sales-Based) | Business Loan (Bank/SBA/Online) |

|---|---|---|

| Speed | Often 24–48 hrs after approval | Days to weeks |

| Approval focus | Cash-flow / deposits; lighter on credit | Credit, collateral, documentation |

| Payments | Daily/weekly; % of sales or fixed ACH | Monthly fixed (predictable) |

| Cost | High; factor rates can imply very high APRs | Lower; SBA 7(a) rates often Prime + spread |

| Best for | Urgent inventory, repairs, marketing pushes | Expansion, equipment/real estate, refinancing |

| Regulatory guardrails | Growing disclosures; state rules vary | Mature compliance + federal programs (SBA) |

Sources on costs/structure and timing:

• SBA program overview and rates context:

SBA lending is running hot in 2025. The SBA reported record activity, 84,400 loans and ~$45B guaranteed for FY25 prior to the recent program freeze, reflecting strong demand for lower-cost capital. sba.gov

Prime-linked rates stabilized lower than the 2023–24 peaks. As of Oct 2025, prime ~7.25%, which flows into many SBA 7(a) rate caps (prime + a spread). That makes loans comparatively attractive versus high-cost short-term products.

Meanwhile, the MCA market keeps growing. Research pegs the global MCA market size at ~$19.65B in 2025 (≈6–7% YoY). That growth mirrors merchants’ continued need for speed and flexible underwriting.

Credit access remains mixed. NFIB’s 2025 small-business trend reports show owners still juggling sales softness and tighter standards in parts of the banking system, one reason MCAs remain in the toolkit.

California’s DFPI expanded protections covering MCAs. The DFPI’s rules (effective late 2023, underscored in April 2025 advisories) bar unfair or abusive practices and require clearer cost disclosures for commercial financing, including MCAs. This raises the floor on transparency for merchants.

Regulators continue to scrutinize abusive structures. High-profile actions and lawsuits against predatory cash-advance schemes reinforce why it’s critical to pick a compliant, transparent funding partner, not just the cheapest-today option.

(These are real, 2025-dated touchpoints you can reference in your blog and sales collateral.)

MCA: Best fit if you have consistent card/bank deposits, ≥6–12 months in business, and can handle daily/weekly remits tied to sales. Funding can land in 24–48 hours after approval.

Loan: Fit improves with higher credit scores, complete financials, collateral (or SBA guarantee), and willingness to wait. Check active SBA lenders in your state to shorten the process.

Speed defines trust in business funding, and Lending Valley’s CEO, Chad Otar, proved it again earlier this year.

In June 2025, a long-time client, Luciano G, urgently needed working capital to secure a supplier deal before the weekend. Instead of lengthy paperwork or back-and-forth calls, Chad personally stepped in. Within minutes, he reviewed the file via text and leveraged Lending Valley’s internal pre-approval process.

✅ Result: Luciano was approved for $80,000 in under 20 minutes, and funds were queued for same-day release.

Here’s how Luciano described the experience in his public review:

“Excellent service always. A few texts and I was approved for 80K in under 20 minutes! You can’t go wrong with Chad at Lending Valley, quick service, no stories, no BS. Simple, easy, and quick.”

This isn’t an isolated event; it reflects the company’s culture. Chad routinely monitors urgent submissions, ensuring merchants who meet basic MCA criteria (consistent card deposits, stable revenue, verifiable processing data) receive near-instant decisions.

In 2025 alone, Lending Valley’s rapid-approval model has helped:

This case reinforces why Lending Valley isn’t just a lender; it’s a true funding partner that blends fintech speed with founder-led accountability.