Our goal at Lending Valley is to provide all small business owners access to the best loans possible for their business. You can rest assured we will get you the best rates in the market!

Running a business is tough. But running one as a minority, woman, or veteran entrepreneur can feel like juggling three jobs at once, managing operations, finding clients, and chasing funding that often feels just out of reach.

The good news? 2025 is a turning point.

More government programs, state-backed initiatives, and mission-driven lenders are finally stepping up to make access to capital faster, fairer, and simpler.

So grab your coffee, and let’s walk through the best financing options available right now, explained in plain English, with real examples and tips that actually matter.

Before diving into specifics, here’s the reality check:

In short: there’s real money out there. You just need to know where to look.

Looking for a rapid and reliable Merchant Cash Advance? Get in touch today! MCA lender

If you’re looking for a classic “get it done” business loan, start here.

The SBA 7(a) and 504 programs are perfect for expanding, buying equipment, or refinancing expensive debt.

Why they’re great:

2025 update: The SBA tweaked its fees and guidelines this year. Some veteran-owned or manufacturing businesses can even get fee waivers on certain loans.

🧠 Pro tip: Always ask your lender for the latest FY2025 fee schedule, because a few percentage points can mean thousands saved.

You’ve probably never heard of SSBCI, but you should.

This federal-state partnership helps banks lend to small businesses that might otherwise be declined.

Think of it as a safety net: the state shares the risk with your lender, making approvals easier, especially for minority- or women-owned firms.

How to access it:

Ask your local bank or CDFI, “Are you part of your state’s SSBCI lending network?”

If they say yes, bingo. You’ve just opened a faster path to approval.

If you’ve ever felt brushed off by a traditional bank, a CDFI might change that story.

They’re nonprofit or mission-driven lenders built to serve underserved and underestimated founders. They care less about your credit score and more about your story, cash flow, and potential.

Real story (2025):

A small logistics company in South Texas partnered with NeighborWorks Laredo, a newly certified CDFI, to secure affordable financing and business coaching. That one partnership kept 20 local jobs alive.

If you’re rebuilding credit or just starting out, start with a CDFI before you go to a big bank.

Here’s a program that deserves more attention.

The MBDA (part of the U.S. Department of Commerce) runs business centers nationwide that help minority founders become lender-ready, from refining their financials to finding investors.

In 2025, the MBDA launched $11 million in new funding to train and assist more minority entrepreneurs.

Think of them as your personal “capital coach.”

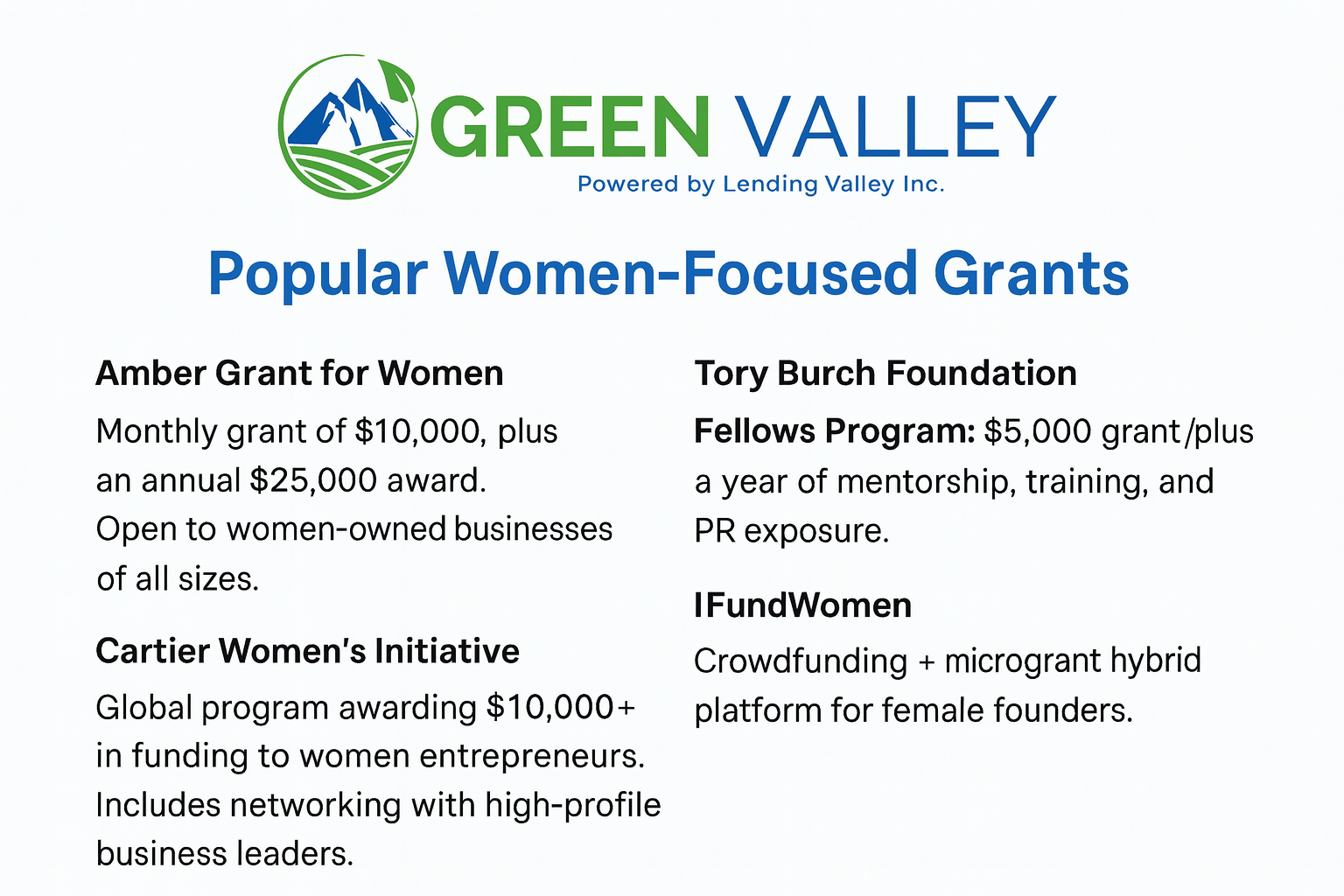

Good news, ladies — 2025 has been your year.

If you haven’t yet, visit the SBA’s WOSB portal and start your certification process. It takes time, but it’s worth every minute.

Veteran entrepreneurs, you’ve got unique advantages too.

The VetCert program centralizes certification so you can qualify for Service-Disabled or Veteran-Owned Small Business contracts.

Pair that with an SBA Express Loan (which waives certain fees for veterans), and you’ve got one of the fastest approval pipelines available in 2025.

Need help preparing your paperwork?

Reach out to a Veterans Business Outreach Center (VBOC), and they’ll walk you through it for free.

These stories prove one thing: access to capital is finally starting to shift in the right direction.

| Business Type / Goal | Start Here | Why |

|---|---|---|

| Need low-cost, long-term capital | SBA 7(a) or 504 Loan | Lowest interest, longest term |

| Struggle with approval odds | SSBCI or CDFI | Easier approvals, more flexible |

| Women-owned startup or scaling brand | WOSB + BMO / AT&T Grants | Free grants + contracts |

| Veteran-owned business | VetCert + SBA Express | Fast approval, fee waivers |

| Minority entrepreneur seeking mentorship | MBDA Business Center | Training + lender intros |

Getting funding in 2025 doesn’t have to feel impossible.

Yes, paperwork, acronyms, and lender jargon can make anyone’s head spin. But today, there are more doors open than ever before for minority-, women-, and veteran-owned businesses.

Start local. Ask questions. And don’t settle for “we’ll get back to you.”

You’ve earned the right to get funded…now go claim it.