Our goal at Lending Valley is to provide all small business owners access to the best loans possible for their business. You can rest assured we will get you the best rates in the market!

Why Female Entrepreneurs Need Better Funding Options

Starting and growing a business isn’t easy, and if you’re a woman entrepreneur, the challenge can sometimes feel double. From pitching to investors who don’t always “get it” to navigating banks that prefer collateral-heavy applications, securing funding has been an uphill climb for many female founders.

The good news? 2025 is shaping up to be a breakthrough year. More lenders, government programs, and private organizations are stepping up with female small business loans and grants. In this guide, I’ll walk you through the best options available right now, along with practical tips to help you apply with confidence.

Why Women-Owned Businesses Still Face Funding Gaps

Let’s be real: women entrepreneurs have made huge strides, yet research shows they still receive a smaller share of traditional small business funding compared to men. For example, a 2024 SBA report highlighted that women-owned businesses are 30% less likely to receive bank loans of the same size as male-owned businesses.

Learn more about small business loans

That’s why targeted funding programs exist to help close this gap and give women an equal footing when it comes to launching and scaling their ventures.

| Loan Type | Loan Amount | Repayment Terms | Key Requirements | Best Suited For |

|---|---|---|---|---|

| SBA 7(a) Standard Loan | Up to $5M | Up to 10 yrs (working capital), 25 yrs (real estate) | 680+ credit score, 2 yrs in business preferred, collateral for loans >$350K, strong business plan | Established women-owned businesses needing major expansion, real estate, or equipment |

| SBA 7(a) Small Loan | Up to $350K | Up to 10 yrs | Similar to Standard 7(a) but streamlined process; may require collateral | Small to mid-sized women-led businesses needing moderate funding |

| SBA Express Loan | Up to $500K | Up to 10 yrs | 650+ credit score, faster processing, higher rates | Women-owned businesses needing fast access to capital |

| SBA Microloan Program | Up to $50K | Up to 6 yrs | 600+ credit score (flexible), business plan, collateral may be required | Startups, home-based, and small women-owned businesses needing small working capital |

| Nonprofit Microloans (Accion, Grameen, LiftFund) | $500 – $50K | Varies (3–6 yrs) | Proof of women ownership, business plan, limited/no credit history accepted | Women entrepreneurs in underserved communities or first-time borrowers |

| Bank Programs (BoA, Wells Fargo, PNC) | $10K – $500K+ | 3–10 yrs | 650+ credit score, a strong relationship with bank, financial statements, and often require 51% women ownership | Women-led businesses with existing banking history seeking larger funding & mentorship |

| Private Grants (Amber, Cartier, Tory Burch) | $5K – $100K+ | N/A (no repayment) | 650+ credit score, a strong relationship with the bank, financial statements, and often require 51% women ownership | Innovative women entrepreneurs seeking growth capital without debt |

| State-Specific Loans/Grants (Florida, Ohio, NY) | $10K – $50K+ | Varies by state | Must be state-registered, 51% women ownership, tax compliance, and business license | Women-owned businesses in specific states seeking local funding & disaster recovery support |

| Unsecured Business Loans (Direct Lenders) | $5K – $250K | 1–5 yrs | 680+ credit score, strong revenue, no collateral | Women-owned businesses with good revenue but no collateral to pledge |

| Veteran & Women Entrepreneur Programs | $10K – $500K | 3–10 yrs | Veteran status + 51% women-owned certification, business plan, credit check | Female veteran entrepreneurs starting or scaling their business |

The SBA 7(a) loan program is the most popular and flexible option for small businesses in the U.S. While it’s technically open to everyone, more lenders are now prioritizing women-owned businesses. This means faster processing times, dedicated loan officers, and access to mentorship and networking programs that specifically support female entrepreneurs.

Types of SBA 7(a) Loans

SBA 7(a) loans aren’t one-size-fits-all , there are several subcategories:

Common Uses of SBA 7(a) Loans for Women Entrepreneurs

Loan Requirements for SBA 7(a)

To qualify, a woman-owned business must meet SBA’s standard criteria:

Benefits of SBA 7(a) for Women

Real Example

A bakery owner in Florida wanted to expand operations but didn’t qualify for a traditional bank loan. She applied for an SBA 7(a) loan of $250,000 through a women-priority pipeline lender. With SBA backing, she secured:

Microloans are small, short-term loans (typically under $50,000) offered by nonprofit lenders, community-based organizations, and the SBA. They are ideal for startups, home-based businesses, and women entrepreneurs who don’t yet qualify for large bank loans.

Common Uses

Loan Requirements

Example

A fashion boutique owner in Texas secured a $15,000 microloan from Accion to build her online store during the pandemic. Within 18 months, her e-commerce sales were generating 40% of her revenue.

Several banks and financial institutions now provide specialized business loan programs for women entrepreneurs. These loans are often bundled with educational workshops, coaching, and networking opportunities.

Examples of Bank Programs

Loan Requirements

Example

A woman running a small marketing agency in New York secured a $100,000 business line of credit through Bank of America’s program. Alongside the funds, she gained access to a mentorship network that connected her with other female founders in tech.

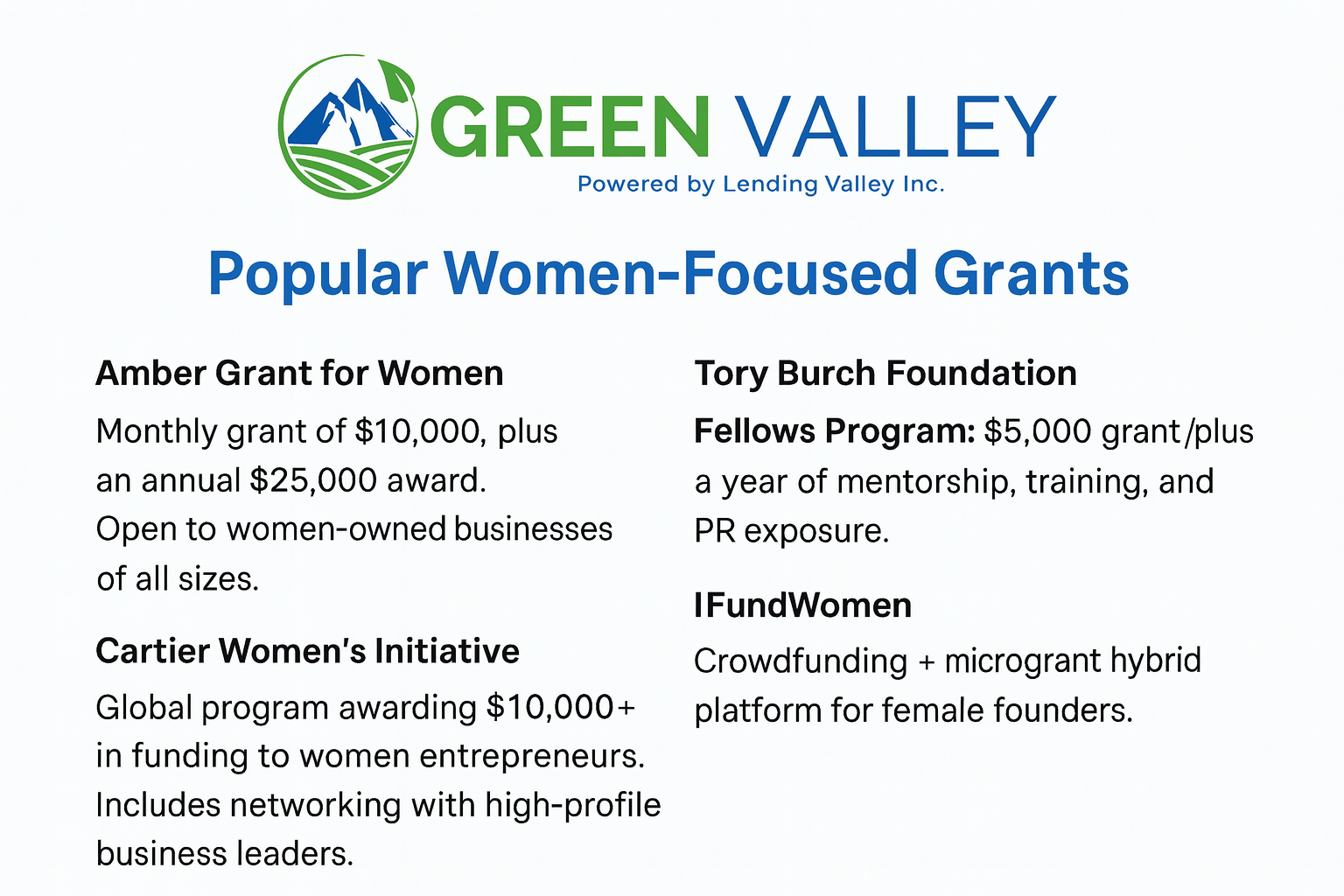

Grants are “free money” , unlike loans, they don’t need to be repaid. Many organizations specifically fund female entrepreneurs, often through competitions or application-based programs.

Popular Women-Focused Grants

Requirements

Example

A health and wellness startup in California won the Amber Grant and used the $10,000 award to expand production of her organic skincare line. The visibility also attracted an angel investor.

Beyond federal options, many states run loan and grant programs targeting women-owned businesses. These are often overlooked but can be easier to qualify for than national programs.

Examples by State

Requirements

Example

A woman-owned catering business in Miami secured a $25,000 loan through Florida’s Bridge Loan Program after a hurricane. The funds helped her restock supplies and resume operations within weeks.

At LendingValley, our mission is to make business financing more accessible, transparent, and supportive, especially for women entrepreneurs across the USA. We believe that when women-owned businesses succeed, communities do too. Here’s how LendingValley plays a role in the journey:

Chad Otar is the driving force behind LendingValley. Drawing on his extensive experience in financial services, small business lending, and entrepreneur support, Chad has built LendingValley to fill a gap he identified in the market: accessible, honest, and woman-friendly business funding.

Although I wasn’t able to access Chad’s LinkedIn profile in full today, here are some of the profiles and traits that define his leadership:

Female small business loans are funding programs designed to support women entrepreneurs. These loans may come with lower interest rates, flexible terms, or mentorship programs targeted at women-owned businesses.

Yes. In the USA, the SBA 7(a) Loan Program, SBA Microloan Program, and Women’s Business Centers all prioritize women-owned businesses. Additionally, some states (like Florida and Ohio) have women-specific funding and grant programs.

For startups, SBA microloans (up to $50,000) and nonprofit lenders like Grameen America are great options. They don’t require extensive credit history and often include training programs. For larger needs, SBA 7(a) loans are the most flexible.

Yes. Many lenders, including microloan providers and some banks, offer unsecured loans. However, the loan amount may be smaller, and the interest rate may be slightly higher compared to secured loans.

Some lenders provide priority pipelines, faster approvals, and mentorship for women-owned businesses. However, terms still depend on credit score, business plan, and revenue history.

Yes. Popular grants include the Amber Grant for Women, Cartier Women’s Initiative, Tory Burch Foundation Fellowship, and state-level women’s business grants. These do not need repayment.

Business plan

Proof of ownership (51%+ women-owned)

Financial statements (2–3 years preferred)

Personal and business credit history

Tax returns

For SBA loans: collateral information (if required)

SBA 7(a) loans can go up to $5 million, while SBA microloans provide up to $50,000. The actual amount depends on your business revenue, use of funds, and creditworthiness.

Yes. Female veterans can access Veterans Advantage Loans (through SBA), along with women-focused grants. Many nonprofit organizations also provide funding specifically for veteran women entrepreneurs.

They can be easier, especially if applying through women-focused lenders or state programs. That said, approval still depends on your credit, business plan, and revenue stability. The “female-owned” status often gives you an advantage in processing and mentorship, not automatic approval.

Most lenders look for a minimum score of 650–680. However, microloan programs may accept lower scores (600 or even no credit history) if the applicant shows strong repayment potential.

Yes. Major banks like Bank of America, Wells Fargo, and PNC have women-focused lending initiatives. These often combine funding with mentorship and networking programs.

Yes. Many successful entrepreneurs stack different funding sources e.g., an SBA microloan for working capital + a state grant for expansion. Just make sure you can manage repayment schedules responsibly.

Maintain a healthy credit score

Prepare a clear business plan

Show cash flow stability

Apply through women-focused programs that provide mentorship and priority support

SBA 7(a) Loans (with women-owned pipelines)

SBA Microloans

Amber Grant for Women

Cartier Women’s Initiative

Bank of America’s Women Entrepreneurs Program

State-specific grants (Florida, Ohio, NY)