Our goal at Lending Valley is to provide all small business owners access to the best loans possible for their business. You can rest assured we will get you the best rates in the market!

Stop Guessing. Start Growing.

Most businesses don’t fail for lack of profit; they fail for lack of cash flow visibility. Meet Vanesh Kumar, our featured Fractional CFO, dedicated to helping LendingValley clients navigate the complexities of business finance.

Securing capital is only half the battle. Managing it is where the growth happens. Vanesh provides high-level financial strategy without the overhead of a full-time executive hire.

“My focus is practical and business-driven: helping owners avoid stress and plan growth with confidence.” — Vanesh Kumar, CFA

As a CFA Charterholder, Vanesh Kumar brings a rigorous, institutional-level perspective to the small and mid-sized business (SMB) sector. With a career built across banking, corporate treasury, and complex credit analysis, he specializes in transforming messy financial data into high-growth capital allocation strategies.

Vanesh understands the unique challenges of the US business landscape, from navigating fluctuating interest rates to meeting the stringent requirements of institutional lenders. He bridges the gap between a company’s current financial state and the “bank-ready” status required to secure competitive financing.

Learn more about Vanesh Kumar

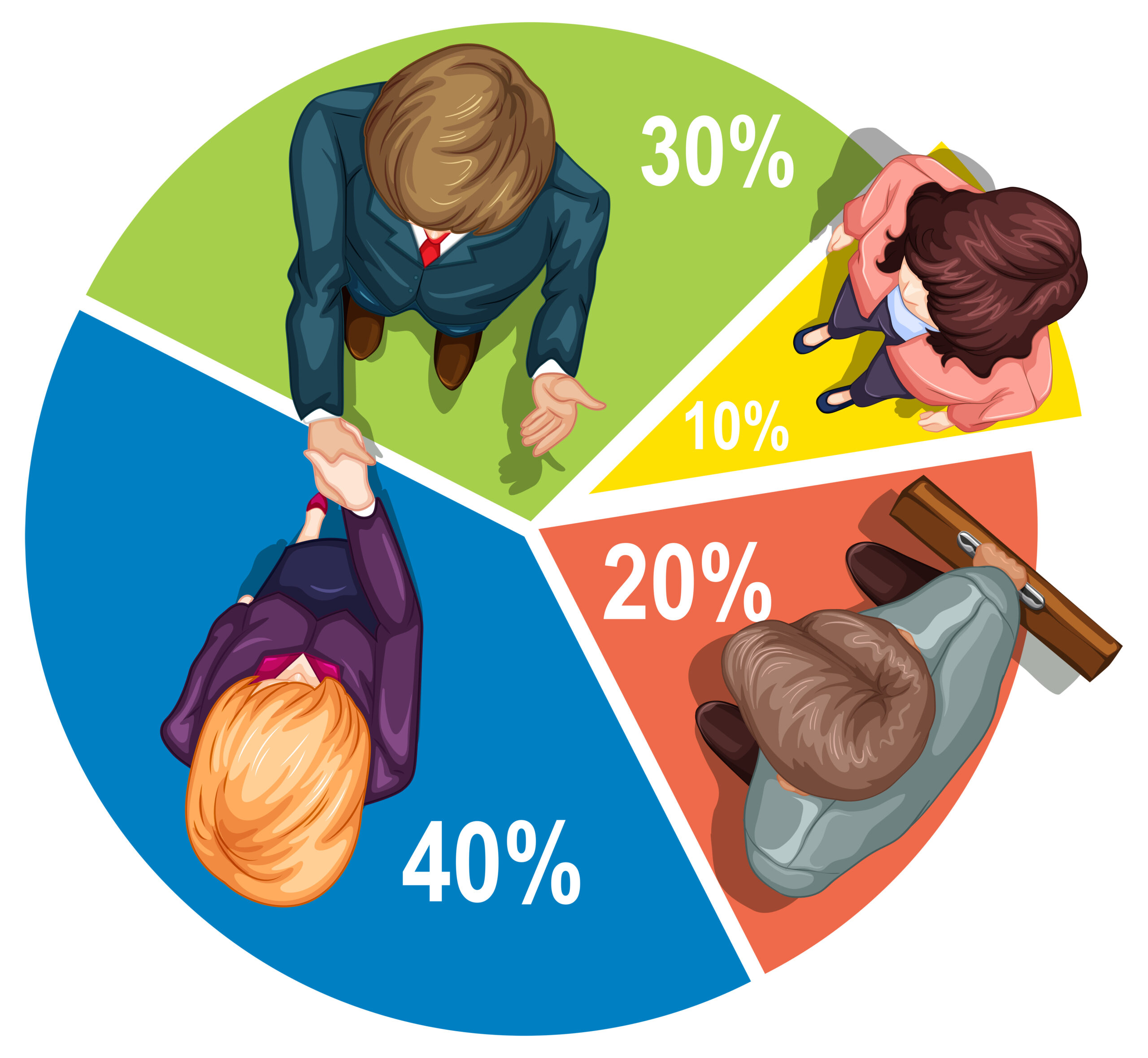

Vanesh provides hands-on fractional CFO services designed to reduce financial friction and maximize owner equity. His approach focuses on four critical pillars of business health:

“In the US market, growth often outpaces cash. My goal is to ensure that your financial infrastructure is strong enough to support your ambitions without the stress of bank pressure.”

In an industry crowded with “consultants,” a CFA (Chartered Financial Analyst) designation represents the highest standard of ethics and analytical rigor in the global finance industry. When you work with Vanesh through LendingValley, you aren’t just getting a report; you are getting a strategic partner who understands credit analysis from the lender’s perspective.

Whether you are preparing for a major acquisition, seeking working capital, or needing a virtual CFO to stabilize your scaling operations, Vanesh provides the clarity needed to make confident, data-backed decisions.th a deep background in banking, treasury, and credit analysis.

He understands exactly how lenders and investors evaluate your business. By bridging the gap between raw data and strategic presentation, he helps founders present their business in the best possible light to financial partners.

Experience Highlights:

Ready to get a clear view of your financial future? Book a short introductory call with Vanesh to see how fractional CFO services can stabilize your cash flow.

Still have questions?

Can’t find the answers you’re looking for? Let’s talk.