Our goal at Lending Valley is to provide all small business owners access to the best loans possible for their business. You can rest assured we will get you the best rates in the market!

Let’s be real for a second, running a business in 2025 is no walk in the park. Between fluctuating market trends and the constant need for quick cash flow, finding a funding partner who actually gets it feels like finding a needle in a haystack.

You’ve probably heard the name Lending Valley floating around. Maybe you saw an ad, or perhaps a fellow business owner dropped their name at a networking event. But the big question remains: Is the hype real?

To save you the endless scroll, we dug deep into the latest Google Reviews, analyzed real client feedback from 2025, and compared their performance against current industry standards.

Here is the unfiltered truth about what business owners are saying about Lending Valley right now.

Current Rating: 4.9/5 Stars (Based on 93+ Verified Google Reviews)

First impressions matter. When you pull up Lending Valley on Google, the sea of five-star ratings is hard to ignore. Unlike many fintech lenders that get bogged down by complaints about hidden fees or ghosting support agents, Lending Valley seems to have cracked the code on relationship-based lending.

Business owners aren’t just leaving star ratings; they are writing paragraphs. The recurring theme? It’s not just about the money, it’s about the people (specifically a funding advisor named Chad, who seems to have a legendary status among clients).

To paint a clearer picture of why these reviews are so high, let’s look at three specific scenarios taken directly from recent client feedback.

Client Profile: A business owner needing emergency capital.

The Situation: Cash flow gaps can kill a business overnight. One recent reviewer, Cristian, found himself in a tight spot needing funds immediately to keep operations running smoothly.

The Lending Valley Solution: According to his review from late 2025, the team didn’t just approve him; they “took care of business in less than a week.”

The Outcome: He described the process as effortless.

Why It Matters: In 2025, speed is currency. A lender that drags its feet for two weeks is a lender that costs you opportunity.

Transitioning to a different perspective, let’s look at clients who need more than just a quick buck.

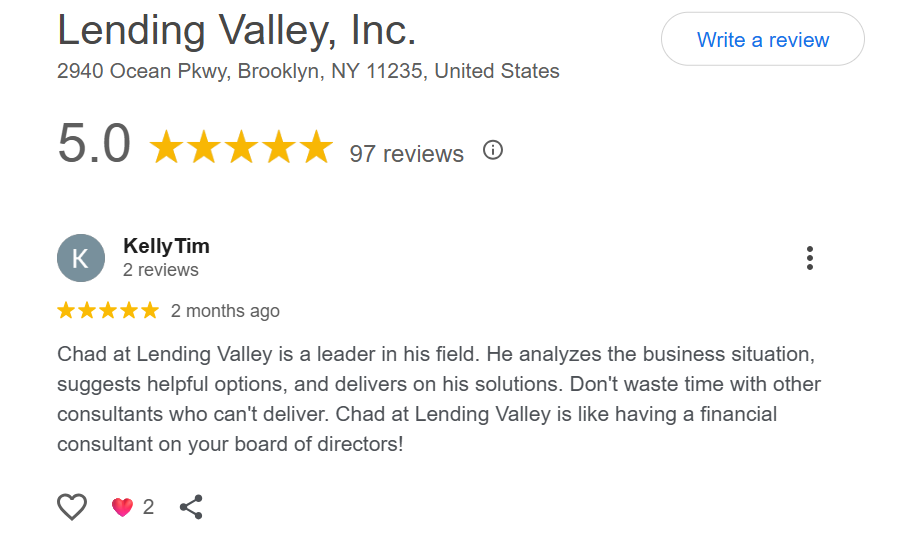

Client Profile: A company looking for long-term growth, not just a band-aid.

The Situation: Many lenders use algorithms to spit out a “Yes” or “No.” Kelly, a business owner, needed someone to actually look at her unique business model.

The Lending Valley Solution: Her review highlights that her advisor, Chad, didn’t just act as a lender but as a “financial consultant on the board of directors.” He analyzed her specific situation and suggested options that made sense for her margins.

The Outcome: She felt supported, not sold to.

Why It Matters: This aligns with a major 2025 trend where business owners are rejecting transactional lending in favor of advisory partnerships.

On the other hand, what happens when you need to come back for round two?

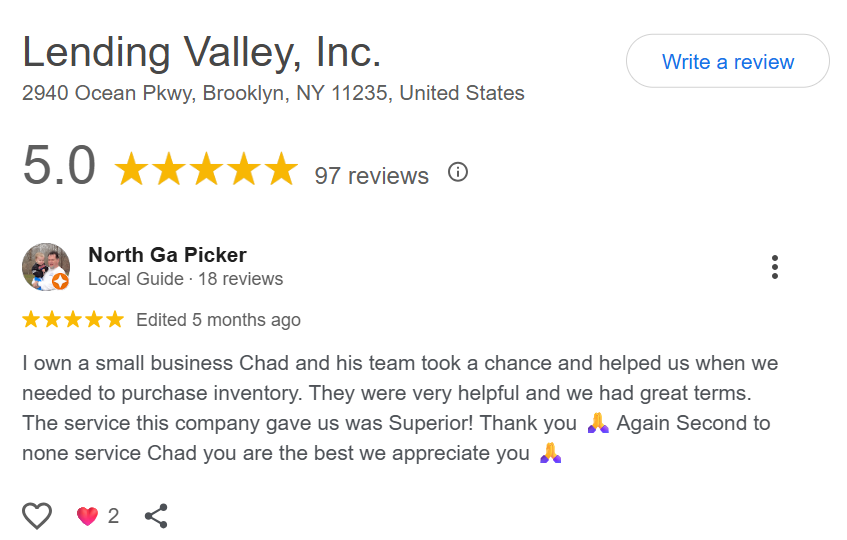

Client Profile: An established business expanding operations.

The Situation: Trust is hard to build and easy to break. A reviewer named Sorin mentioned returning for a second round of funding, a critical test for any lender.

The Lending Valley Solution: The second experience was just as seamless as the first. The reviewer noted “zero regrets” and praised the consistent professionalism.

The Outcome: A solidified long-term partnership.

Why It Matters: Retention rates in fintech are historically low. A client coming back voluntarily speaks volumes about the transparency of the first deal.

To understand where Lending Valley fits in, we need to look at the broader market. Here are three key statistics from 2025 that explain why their approach is winning:

In light of this information, let’s break it down simply.

The Pros:

The Cons:

If you have perfect credit and three months to wait, a traditional bank is still your cheapest route.

However, if you are part of the modern 2025 economy, where speed, flexibility, and a human understanding of your unique cash flow matter, Lending Valley appears to be the real deal. The reviews don’t lie: business owners are finding a partner here, not just a paycheck.

Ready to see for yourself?

If you want to check out these reviews firsthand or start a conversation with their team, you can find them directly on Google or visit their site.

(Disclaimer: Financial decisions should always be made after consulting with your own accountant or financial advisor.)