Our goal at Lending Valley is to provide all small business owners access to the best loans possible for their business. You can rest assured we will get you the best rates in the market!

Let’s rip the band-aid off right now. If you are currently staring at a Merchant Cash Advance (MCA) offer, the number you see highlighted on the contract that “1.3” or “1.4” is not your interest rate. If you assume it is, you are about to pay significantly more than you planned. It is 2026, and while money moves faster than ever thanks to AI-driven banking, the complexity of financial products has also increased. You can get approved for Business funding in Texas or a Business Loan in Brooklyn while waiting for your morning coffee, but that speed comes with a hefty price tag often hidden behind confusing jargon.You need to look past the instant approval and calculate the true MCA cost yourself before you sign on the dotted line.

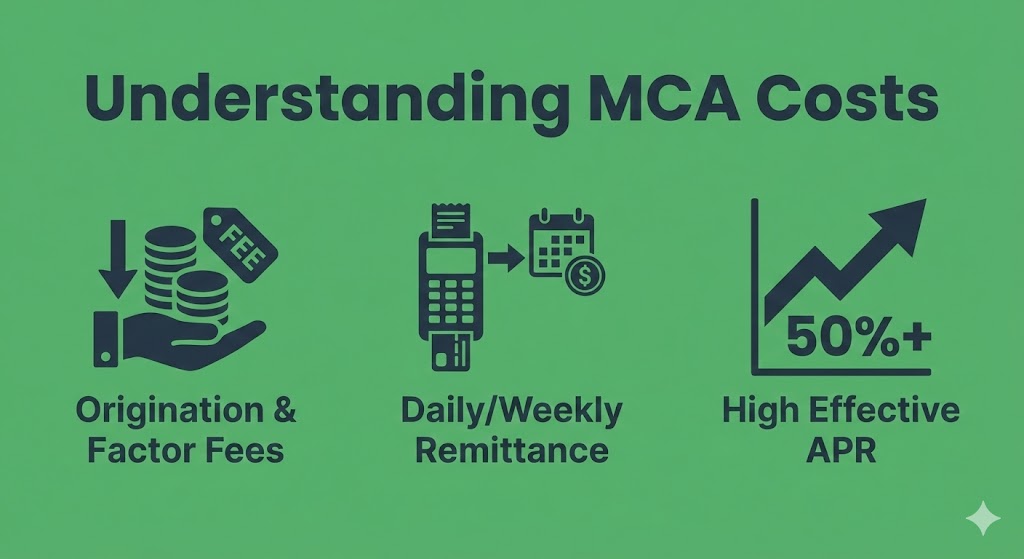

We see this scenario play out every single day at Lending Valley. A smart, capable business owner receives an offer for $50,000, sees a “1.25 factor rate,” and thinks, “Okay, 25% interest. That is high, but I can handle it.” This is a dangerous misconception. Depending on how fast the lender takes that money back, that “1.25” could actually translate to an Annual Percentage Rate (APR) of 80%, 120%, or even higher. This guide is your financial calculator and your warning label. We are going to break down the true MCA cost, expose the hidden fees that salespeople gloss over, and teach you the specific math that predatory lenders hope you never learn.

The single biggest mistake business owners make when evaluating alternative finance is treating a factor rate like an APR. They are fundamentally different metrics, like comparing distance in miles to time in hours. An APR (Annual Percentage Rate) measures the cost of borrowing money over the course of a full year, which is the standard metric used by traditional banks. A Factor Rate, however, is a simple multiplier used to calculate the total payback amount, regardless of time.

This distinction is critical because time is the enemy in an MCA. In a traditional loan, if you pay it off early, you usually save on interest. In an MCA, the total payback amount is typically fixed the moment you sign the contract. Whether you pay it back in six months or six weeks, the cost is often identical. This means that the faster the lender retrieves their money via daily withdrawals, the higher your effective APR skyrockets. Understanding this difference is the first step in calculating the real MCA cost and ensuring you aren’t paying triple-digit interest rates for short-term capital.

What are you waiting for , get a transparent quote now,

Let us run the math for you. Compare real offers with zero hidden fees and see exactly what you will pay back.

The math behind the offer is actually quite simple once you strip away the confusing terminology. The formula lenders use is: Advance Amount x Factor Rate = Total Payback Amount.

Let’s look at a practical example. Imagine you run a manufacturing plant and you are looking for Small Business funding in Ohio to purchase raw materials. You apply for $100,000, and the lender offers you a factor rate of 1.35. To find your total obligation, you multiply $100,000 by 1.35, resulting in a total payback of $135,000. This means the raw cost of the capital is $35,000.

On paper, paying $35,000 to access $100,000 might seem acceptable if the profit margins on your materials are high enough. But here is the kicker: Time. If the lender structures the deal so that they collect that $135,000 in just four months via aggressive daily payments, you are paying $35,000 to use that money for only 120 days. That is incredibly expensive fuel for your business engine. When you annualize that cost, you are looking at an effective APR that would make a credit card look cheap.

In 2026, the lending landscape has shifted. AI-driven underwriting has made approvals lightning fast, but the costs have adjusted to match the risk. We analyzed thousands of contracts from New York to Florida to give you a realistic benchmark of what you should expect to pay.

For top-tier borrowers those with excellent credit (700+ FICO), strong consistent revenue, and few negative days factor rates typically range from 1.10 to 1.25. This translates to an estimated APR of 25% to 60%. However, for the average business owner (B-Paper), rates usually hover between 1.25 and 1.35, pushing the APR into the 60% to 90% range. For high-risk applicants (C-Paper) often seeking emergency Business funding in Texas or elsewhere, factor rates can exceed 1.50, with effective APRs soaring past 200%. It is also worth noting that in 2026, we are seeing a rise in “junk fees,” where lenders lower the factor rate slightly to appear competitive but add 5% to 10% in “marketing” or “underwriting” fees on the back end.

To truly understand the impact of these numbers, you need to see them in the context of real business operations.

Mario owns Mario’s Electronics in Brooklyn, NY. He found himself in a position where he could buy holiday inventory at a massive discount, but he needed $40,000 immediately. The situation was dire and he couldn’t wait for a bank loan, so he sought a Business Loan in Brooklyn via an MCA. He was offered $40,000 at a factor rate of 1.18 over a 9-month term. This meant his total payback was $47,200 ($40,000 x 1.18). Mario paid $7,200 for the access to capital. However, because he sold that discounted inventory for a $20,000 profit, the cost was entirely justified. The MCA cost was simply a line item expense that enabled a larger profit. This is how the product is designed to work.

The owner of Lone Star Drywall in Austin, Texas, faced a payroll crisis when a general contractor delayed a massive payment. He needed Business funding in Texas instantly to keep his crew from walking off the job. With a credit score of 580, his options were limited. He accepted an offer for $60,000 with a factor rate of 1.42 and a very short term of 4 months. The math was brutal: $60,000 x 1.42 equaled a payback of $85,200. He paid $25,200 in fees in just 120 days. While the funding saved his payroll and kept his business alive, the effective APR was over 150%, wiping out his profit margin for the entire quarter. It was a survival move, not a growth move.

A trucking logistics company in Cincinnati was looking for Small Business funding in Ohio to repair a fleet vehicle. The owner signed a contract for $25,000 with a factor rate of 1.25, thinking he got a great deal. He failed to read the fine print regarding the “shadow” MCA cost. The lender deducted a $2,500 “Origination Fee” and a $499 “Admin Fee” upfront. This meant that while he was responsible for paying back the full calculation based on $25,000 ($31,250), only $22,000 actually hit his bank account. His real cost wasn’t 1.25; once you account for the missing cash, it was significantly higher. Always check the “Net Funded Amount” before signing.

When calculating the total MCA cost, you must look beyond the big number on the front page. There are “shadow costs” that can drain your account if you aren’t careful. The most common is the Origination Fee, which typically ranges from 2% to 10%. This is taken out before the wire is sent. If you borrow $10,000 with a 10% fee, you only receive $9,000, yet you pay interest on the full $10,000.

Beyond origination, look out for Admin or Processing Fees. Some lenders charge a monthly or weekly fee (e.g., $49/month) just for the “privilege” of managing your account. Wire fees of $25 to $50 per transfer are also standard. Finally, be wary of ACH Bounce Fees. If you miss a daily payment because of low funds, the lender will charge a penalty (often $50-$100), and your bank will charge an NSF fee. This double whammy can spiral quickly.

Want to really understand your offer? You need to calculate the effective APR. Most lenders won’t tell you this number, but you can estimate it yourself.

First, calculate the total cost of the loan (Total Payback – Funded Amount). Then, divide that cost by the funded amount. Multiply that result by 365 (days in a year). Finally, divide that number by the term length in days, and multiply by 100. For example, if you borrow $10,000 and pay back $13,000 over 6 months (180 days), your cost is $3,000. Divided by $10,000, that is 0.3. Multiplied by 365 is 109.5. Divided by 180 is 0.608. That is an APR of 60.8%. Suddenly, that “1.3 rate” looks very different.

We are about to dive deep into the math and fees, but if you need to back up and understand the mechanics first, check out our simple breakdown of What Is an MCA Loan.

Pros of MCAs: The primary benefit is speed; you can often get cash in your account in 24 hours, which is critical for emergencies. Accessibility is another major pro, as businesses with 500 FICO scores or tax liens can still get approved based on revenue. It is also usually unsecured, meaning you don’t have to pledge your house or car as collateral. Finally, if you use the funds for high-ROI opportunities (like Mario in Brooklyn), the high cost can be worth the immediate return.

Cons of MCAs: The cost is the biggest drawback. APRs typically range from 40% to over 120%, making it one of the most expensive forms of capital. The frequency of repayment is also a challenge; daily or weekly payments can put a massive strain on your operational cash flow. The confusion surrounding factor rates often leads business owners to underestimate the true cost, and the short terms can trap businesses in a cycle of debt if they aren’t careful.

Myth: “I can save money by paying off my MCA early.” Fact: Usually, no. Most MCA contracts are fixed-cost agreements. You owe the full payback amount whether you pay it in 4 months or 8 months. You must negotiate a “prepayment discount” clause before signing to get any benefit from early payment.

Myth: “Factor rates are regulated by the Federal Reserve.” Fact: No. Because MCAs are commercial transactions (technically a purchase of receivables) and not loans, they bypass most federal interest rate caps and truth-in-lending regulations that apply to consumer loans.

Myth: “I can’t get a Business Loan in Brooklyn or elsewhere if I have an MCA.” Fact: You can, but it is harder. Traditional banks view daily MCA payments as a massive liability on your cash flow. You usually need to pay off the MCA first (or use a consolidation loan) to qualify for better bank rates.

Calculating the cost is just one piece of the puzzle. To really protect yourself, you need to know what else to look for like personal guarantees and reconciliation clauses. Check out our guide on the Top 10 Questions Business Owners Ask Before Taking an MCA to make sure you aren’t missing any red flags.

The problem isn’t necessarily the MCA product it is the lack of transparency. Business owners are signing contracts they don’t fully understand. Lending Valley acts as your translator and negotiator in this chaotic market. We break down the offer for you, explicitly telling you, “Hey, this isn’t 20% interest, it’s actually 80% APR.”

Instead of forcing you into one offer, we generate multiple options from our network. Maybe you qualify for a Term Loan or a Line of Credit instead of an MCA? You won’t know unless you compare. Whether you need Business funding in Texas for oil equipment or Small Business funding in Ohio for a restaurant renovation, we match you with lenders who understand your industry. We also fight to remove unnecessary “junk fees” from the contract before you sign, ensuring you get the most net capital possible.We strip away the confusion to ensure the MCA Funding you receive is transparent, fair, and actually helps you grow.

| Feature | Big Bank (Chase/Wells) | Direct Online Lender | Lending Valley |

| Cost (APR) | 7% – 12% | 30% – 90% | Varies (We find the lowest) |

| Transparency | High | Low (Hidden fees) | High (Advisory approach) |

| Speed | 1-2 Months | 24 Hours | 24 Hours |

| Approval Odds | Low (<20%) | High (>80%) | High (>80%) |

| Flexibility | Low | Low | High (Multiple options) |

A: Rarely. Most business credit cards cap out at 24-29% APR. An MCA often starts at an effective APR of 40%. You should generally use an MCA only when you need a cash amount larger than your credit card limit allows.

A: Yes. For a Business Loan in Brooklyn, if your credit is poor, an MCA is often the only viable option. However, Lending Valley can sometimes find “Revenue-Based Financing” alternatives that are slightly cheaper than a standard MCA.

A: Anything under 1.20 is considered excellent and reserved for strong businesses. A rate of 1.20 to 1.35 is standard for the industry. Anything over 1.40 is considered high-risk and is very expensive.

A: Texas has a booming industrial and tech sector, leading to high demand for capital. Lenders love the volume coming from the state. However, Texas also has specific state disclosure laws, so make sure your lender complies with them.

A: Negotiate! You can often negotiate the “Origination Fee” down from 5% to 2% just by asking. Also, ask for a longer term (e.g., 12 months instead of 6) to lower the daily payment strain, which helps cash flow even if the total payback amount stays the same.

A: Traditional bank loans do. MCAs usually do not. If you don’t want to pledge your house or equipment, an MCA is a safer asset play, even if the cash cost is higher.

A: It gets ugly fast. Most contracts have a “Confession of Judgment” (depending on the state) or a personal guarantee. The lender can freeze your accounts. Communication is key if you can’t pay, call them immediately to restructure.

The MCA cost is not just a abstract number on a page; it is a real bite out of your profit margin that affects your ability to grow, hire, and operate. Used correctly, an MCA is a powerful tool to bridge a gap or seize an opportunity that would otherwise pass you by. Used blindly, it is a trap that can suffocate your business.

Don’t be the business owner who pays $20,000 in fees for a loan you didn’t understand. Whether you are hunting for Business funding in Texas, a Business Loan in Brooklyn, or Small Business funding in Ohio, the rules remain the same: Do the math, understand the terms, and never sign out of desperation.

Ready to see the real numbers?

Speak to a Funding Advisor Now, Don’t guess. Talk to a human who can explain the APR and factor rate in plain English before you commit.