Our goal at Lending Valley is to provide all small business owners access to the best loans possible for their business. You can rest assured we will get you the best rates in the market!

For many entrepreneurs, bad credit history feels like a dead end when trying to access funding. Missed payments, defaults, or simply not having a long credit record can leave business owners struggling to find lenders willing to take a chance. But in reality, having bad credit doesn’t close all doors; it just means you need to look for alternative financing paths and lenders who understand the realities of small business challenges.

At Lending Valley, we’ve helped countless entrepreneurs with less-than-perfect credit secure funding by focusing on cash flow, business potential, and tailored repayment options instead of just a number on a credit report.

This guide breaks down not only the best loan options for small businesses with bad credit but also practical strategies, real-world examples, and insider tips to increase your approval chances.

A credit score below 580 usually falls into the “bad” category. But it’s not just about the number. Lenders consider your overall financial behavior, such as:

👉 Example: A restaurant owner with a credit score of 540 might still qualify for financing if their business shows consistent monthly revenue of $15,000.

Traditional banks often see poor credit as a high-risk factor, but modern online lenders like Lending Valley use AI-driven underwriting that weighs revenue streams, customer retention, and industry trends. This opens doors for business owners who have the sales to back up repayment, even if their credit report isn’t perfect.

But challenges don’t mean impossibility. By learning where to apply and how to position your business, you can still secure affordable financing tailored to your needs.

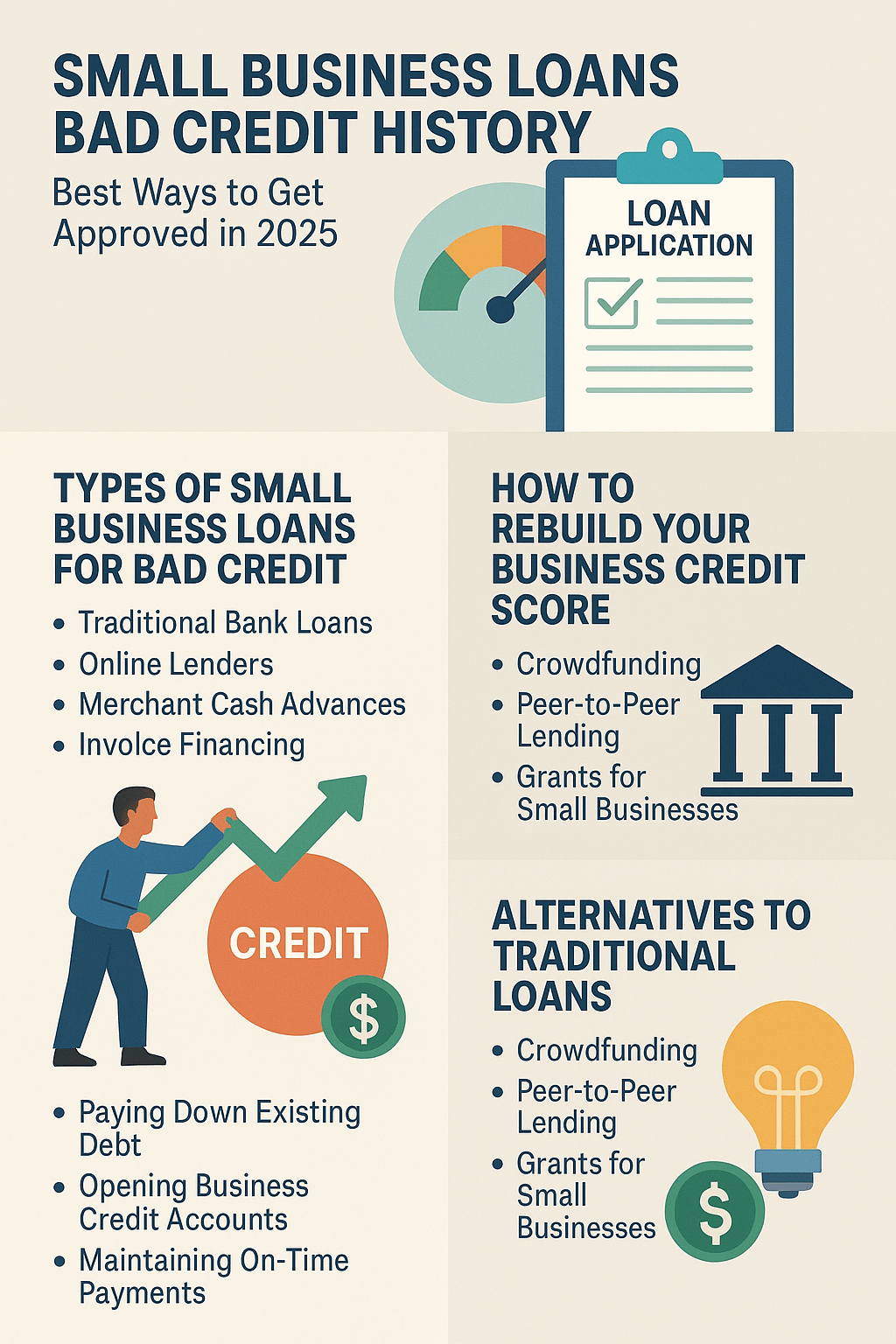

Tougher to qualify for, but it may still work if you’ve rebuilt part of your credit.

Read more about Best Short Term Loan Lenders USA | Compare Rates & Options

Online lenders are far more flexible. Lending Valley, for example, focuses on business revenue, merchant transactions, and industry growth rather than solely on credit scores. This means small businesses in retail, trucking, or e-commerce can still qualify for working capital loans.

Provide lump sums that are repaid through a percentage of daily credit card sales. Quick funding but higher costs.

Borrow against unpaid invoices to bridge cash flow gaps. Best for service businesses with long billing cycles.

Smaller amounts (under $50,000) are often issued by nonprofits or community development lenders. Great for startups and minority-owned businesses.

👉 Example: A trucking company with poor credit secured a $40,000 equipment financing loan through Lending Valley by using trucks as collateral, despite a FICO score of just 560.

When banks and standard loans feel out of reach, these alternatives can make all the difference:

Platforms like Kickstarter and Indiegogo allow entrepreneurs to pitch their idea directly to the public. This not only provides funding but also validates your product.

Example: A small bakery in New York raised $25,000 via Kickstarter to expand operations after being denied a bank loan due to poor credit.

Platforms like LendingClub connect borrowers directly with investors. Interest rates may still be higher, but approval requirements are often more flexible.

Government and nonprofit grants, such as SBA Grants, FedEx Small Business Grant Contest, and local economic development grants, don’t require repayment, making them ideal for startups with limited credit history.

Lending Valley Tip: Always apply for industry-specific grants. For example, if you’re in tech, look for innovation-focused grants; if you’re in hospitality, check local tourism funds.

Everything You Need To Know About Merchant Cash Advances

Improving credit isn’t just about securing one loan, it’s about building a long-term financial foundation.

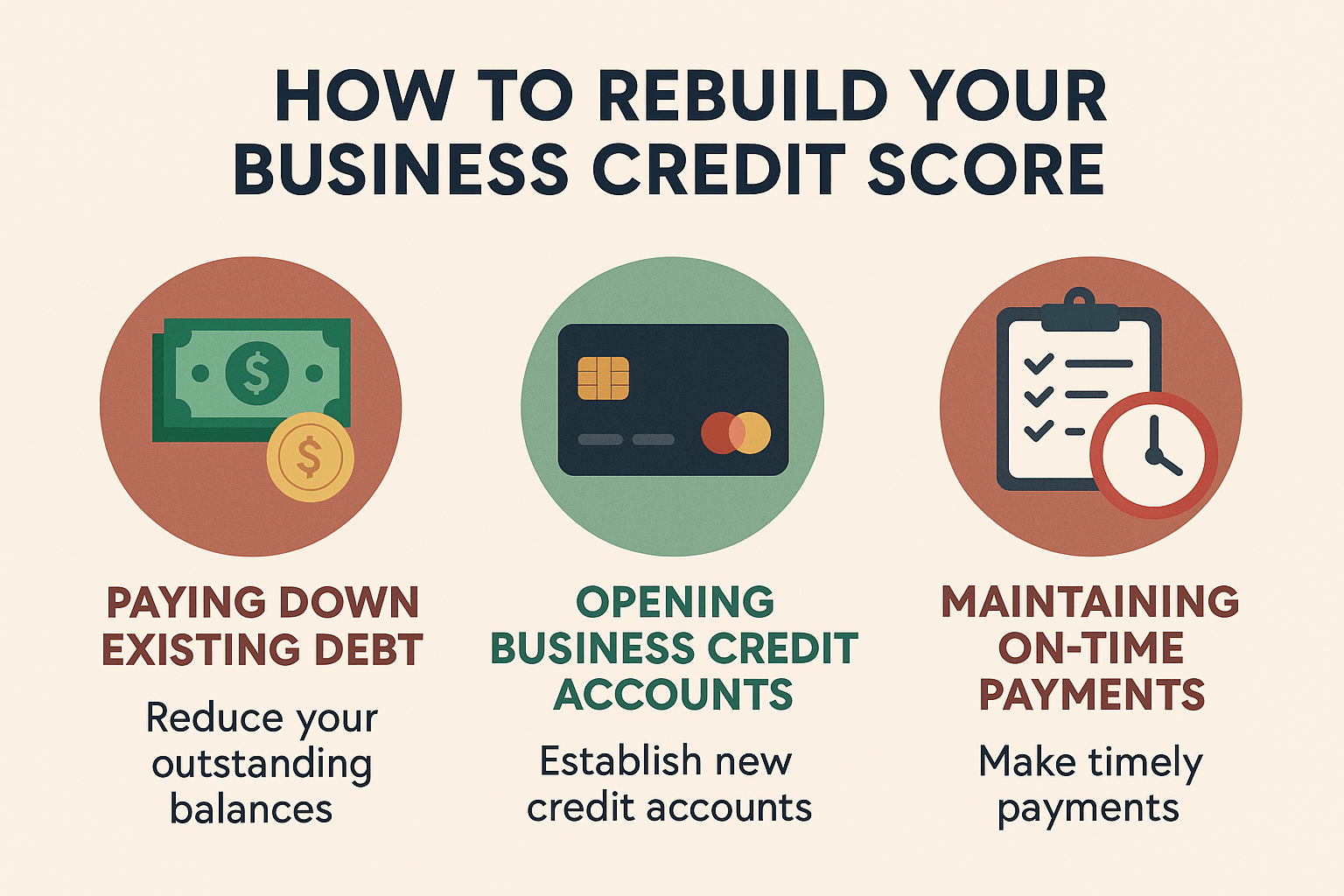

Use the avalanche method (paying high-interest debts first) to reduce overall costs faster.

Start with vendor accounts that report to business credit bureaus (Dun & Bradstreet, Experian Business, Equifax).

Automate bills to avoid missed payments. Even small accounts (like utility bills or office supply vendors) help build credibility.

Example: A retail store owner boosted their credit score from 540 to 620 in 18 months by paying down $10,000 in credit card debt and consistently using a secured business credit card.

Regularly check your business and personal credit reports for errors. Dispute inaccuracies promptly.

Like most business decisions, borrowing money with a low credit score has both upsides and downsides. Understanding both helps you make smarter choices.

✅ Access to capital you otherwise wouldn’t get – Even if you can’t qualify for a traditional bank loan, alternative lenders give you a chance.

✅ Potential to rebuild your credit – Making consistent, on-time payments on a small business loan helps improve your score over time.

✅ Fuel for growth – Whether it’s buying inventory, covering payroll, or launching a new service, funding can give your business a much-needed boost.

👉 Example: A coffee shop owner in New Jersey with poor credit secured a $20,000 working capital loan through Lending Valley. After six months of consistent repayment, not only did their credit score improve, but they also doubled their customer base thanks to the expansion.

⚠️ Higher costs – Expect higher interest rates compared to borrowers with good credit.

⚠️ Strain on cash flow – Short repayment periods can create financial stress if revenue dips.

⚠️ Collateral at risk – If you default on a secured loan, you could lose valuable assets like equipment or vehicles.

It’s easy to feel desperate when money is tight, but rushing into a bad decision can hurt more than help. Here are mistakes to avoid:

👉 Lending Valley Tip: Always ask the lender to explain total repayment costs in plain language. If they dodge the question, that’s a red flag.

Getting approved with bad credit takes strategy, not just luck. Here are some insider tips:

👉 Example: A trucking company owner started with a $15,000 MCA from Lending Valley. After paying it off, they qualified for a $50,000 line of credit six months later.

Q1: Can I get approved if my credit score is under 550?

Yes. While traditional banks may decline, alternative lenders like Lending Valley often approve loans based on revenue, not just credit scores.

Q2: Are SBA loans realistic for bad credit borrowers?

It depends. Standard SBA loans usually require stronger credit, but SBA Microloans and Community Advantage Loans can be more flexible.

Q3: What’s the best loan option for a new business with bad credit?

Microloans and crowdfunding are excellent starting points since they don’t rely heavily on credit history.

Q4: How fast can I get funding with bad credit?

Online lenders like Lending Valley can fund in as little as 24–48 hours, depending on documentation.

Q5: Will taking a loan with bad credit hurt my business further?

Not if you manage it responsibly. In fact, timely repayments can help rebuild your credit score.

Q6: Do lenders really care about my business plan?

Absolutely. A strong plan shows you know how to use the funds wisely and repay on time. Many lenders are willing to overlook credit issues if your business strategy looks solid.

Bad credit doesn’t define your future; it’s just one part of your financial story. While traditional banks may slam the door, alternative lenders, creative financing, and proven strategies can open new opportunities.

The key is to approach funding with a plan:

At Lending Valley, we believe every entrepreneur deserves a chance, no matter their credit history. We’ve seen firsthand how a loan, even a small one, can help businesses survive, grow, and thrive.

👉 Don’t let past credit mistakes hold you back. Explore your funding options today, take small steps toward rebuilding, and give your business the financial foundation it deserves.