Our goal at Lending Valley is to provide all small business owners access to the best loans possible for their business. You can rest assured we will get you the best rates in the market!

Launching a startup is exciting, but it also requires money. From hiring your first employees to marketing your product, every step needs funding. The challenge? Many startups don’t have property, vehicles, or equipment to pledge as collateral for a traditional loan.

That’s where unsecured business loans for startups come in.

This guide will walk you through everything you need to know about unsecured startup loans, how they work, who qualifies, the pros and cons, alternatives, and how Lending Valley and founder Chad Otar can help you secure the right funding.

An unsecured business loan for startups is financing that does not require you to pledge collateral such as real estate, vehicles, or equipment. Instead of assets, lenders make approval decisions based on factors like your personal credit score, business financials, projected cash flow, and the strength of your business plan. In many cases, lenders will also ask for a personal guarantee or a UCC lien, which gives them legal claim over future business assets if the loan goes unpaid. In simple terms, you don’t risk losing a building or equipment if you default, but you are still personally responsible for repayment.

Unsecured loans are especially valuable for new businesses that lack physical assets but still need capital to grow. For example, imagine a tech startup building a mobile app.

The founders don’t own office property or expensive machinery, so a traditional secured loan is out of reach. By applying for an unsecured loan, they can use their strong personal credit and detailed business plan to borrow funds for product development and marketing.

Another scenario is an e-commerce store that experiences seasonal sales spikes. During off-peak months, the business may struggle with cash flow. Instead of pledging assets they don’t have, the owner secures an unsecured line of credit to cover inventory purchases and advertising costs, then repays the loan when revenue increases.

For many entrepreneurs, unsecured loans provide a faster and more flexible path to funding compared to secured bank loans. They are ideal when speed matters, for instance, when you need to launch a campaign quickly, pay employees, or cover supplier invoices while waiting for customer payments.

👉 In short, unsecured business loan startups are a practical choice when you want access to capital without risking your property, but you should understand that lenders still expect accountability through credit checks, guarantees, and timely repayment.

Startups often lack hard assets, but they still need capital to:

Unsecured loans let new businesses access money faster and with less paperwork compared to traditional secured loans.

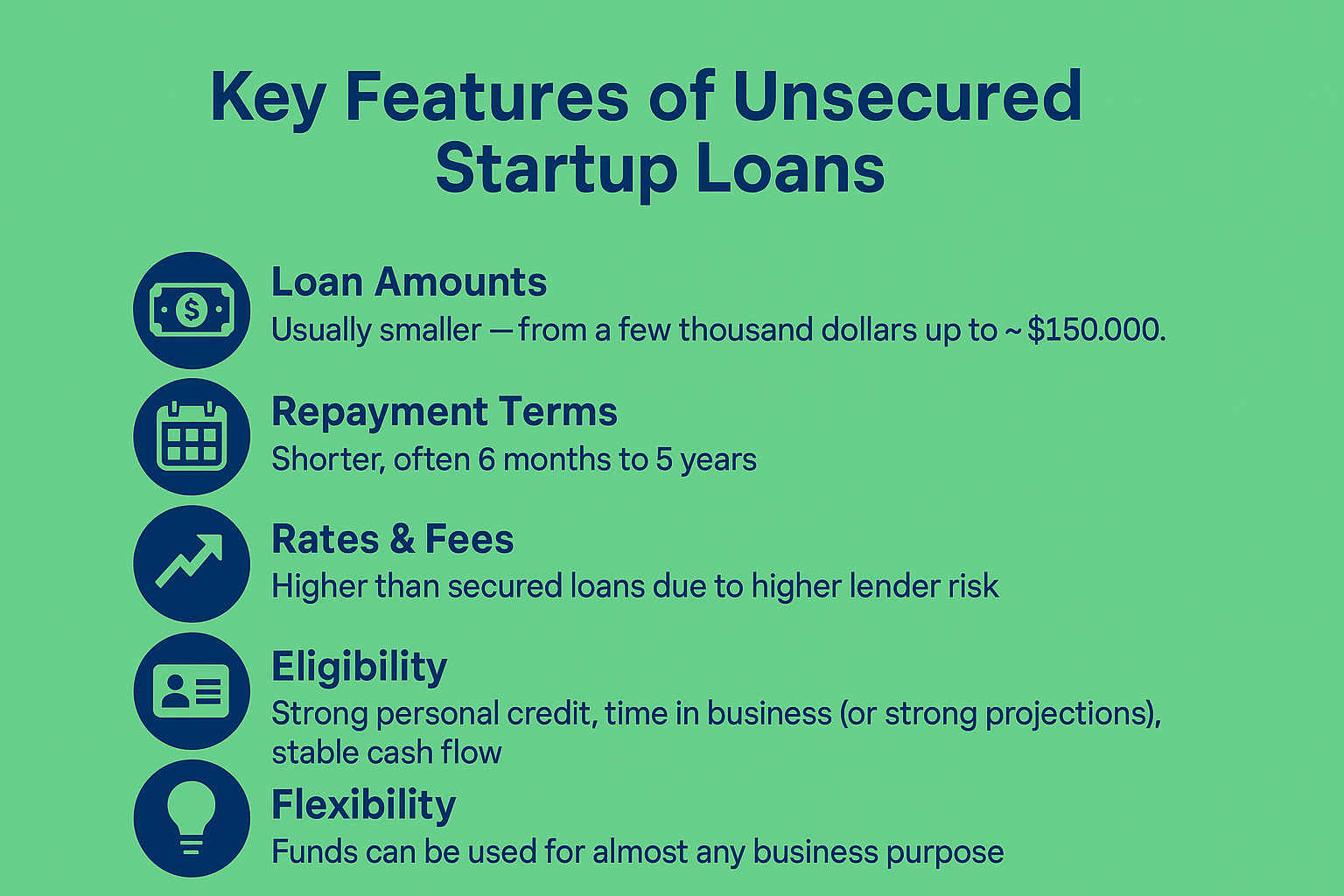

Unsecured business loan startups typically come with smaller loan amounts, ranging from just a few thousand dollars to around $150,000, making them suitable for early-stage businesses that need quick access to capital without risking assets.

https://www.lendingvalley.com/loan/unsecured-business-loan

Repayment terms are shorter, often between six months and five years, which helps lenders reduce long-term risk but requires startups to manage cash flow carefully. Because no collateral is involved, interest rates and fees are higher than secured loans, reflecting the added risk for lenders. Learn more about short term financing

In 2025, the average unsecured business loan interest rate in the U.S. ranges from 7% to over 30% APR, depending on creditworthiness and revenue history.

Approval depends heavily on strong personal credit scores, reliable cash flow, or solid financial projections, since many startups lack a long business track record.

The biggest advantage is flexibility, funds from unsecured loans can be used for almost any purpose, from paying employees and purchasing inventory to launching marketing campaigns. With the global unsecured business loan market expected to surpass $5.5 trillion in 2025, more entrepreneurs are turning to these loans as a practical financing option to scale their ventures without pledging valuable assets.

Not all unsecured loans are created equal. Each option has its own purpose, benefits, and risks. Here’s a closer look at the most common forms of unsecured startup financing, with examples of when each might fit.

An unsecured term loan gives you a lump sum upfront that you repay over a fixed period, often between 1 and 5 years. These loans are best when you need a set amount for a one-time expense.

Example: A tech startup needs $40,000 to launch its first marketing campaign before a product launch. Instead of pledging office equipment as collateral, the founder applies for an unsecured term loan. The bank approves based on the founder’s strong personal credit and cash flow projections. Repayments are made in equal monthly installments until the loan is cleared.

Best for: Marketing campaigns, hiring key staff, or purchasing software tools.

Think of this as a business credit pool. The lender approves you for a maximum limit (say, $75,000). You can draw funds when you need them and repay only what you borrow. As you repay, the credit becomes available again, much like a credit card, but usually with lower rates.

Case Study: A seasonal e-commerce business struggles with cash flow gaps during off-peak months. With a line of credit, the owner borrows $20,000 to cover supplier payments, then repays once holiday sales roll in.

Best for: Managing cash flow, emergencies, or seasonal expenses.

Business credit cards are the easiest unsecured financing tool to access. They’re especially useful for startups with small, recurring expenses. They also help build your business credit history if used responsibly.

Example: A graphic design studio uses a business credit card with a $15,000 limit to cover software subscriptions, travel costs, and office supplies. The founder pays off the balance monthly, avoiding interest charges and earning rewards points.

Best for: Small day-to-day expenses, subscriptions, and building credit.

Microloans are smaller loans, usually $500 to $50,000, offered by nonprofits, community lenders, or SBA programs (in the U.S.). They’re often more flexible with credit requirements and are startup-friendly.

Case Study: A bakery owner applies for a $20,000 SBA microloan to buy ovens and ingredients. The loan is approved because the SBA program doesn’t require heavy collateral for amounts under $25,000. The bakery grows, and the owner repays the loan in two years.

Best for: New businesses needing small amounts to get started.

If your startup already has paying clients but cash is stuck in unpaid invoices, invoice financing can help. Lenders advance you a percentage of the invoice value (often 70%–90%), then collect directly from your customer.

Example: A digital marketing agency invoices a corporate client for $50,000, but the client has 60-day payment terms. To keep payroll going, the agency uses invoice factoring to get $40,000 upfront. When the client pays, the lender takes its fee and releases the balance.

Best for: Businesses with strong B2B clients but long payment cycles.

In RBF, you borrow capital and repay it as a percentage of your monthly revenue, rather than fixed installments. Payments adjust with your sales, higher in good months, lower in slow months.

Case Study: A SaaS company raises $100,000 through an RBF lender to scale digital advertising. Instead of fixed monthly repayments, the company pays 8% of its monthly revenue until the loan and agreed return are repaid. This flexibility protects them during slow quarters.

Best for: High-growth startups with variable income, like SaaS, e-commerce, or subscription models.

| Financing Type | Loan Size | Best Use | Example Scenario |

|---|---|---|---|

| Term Loan | $10k–$100k | One-time big expense | Marketing campaign |

| Line of Credit | Up to $150k | Cash flow gaps | Seasonal inventory |

| Credit Cards | $5k–$25k | Small purchases | Software, supplies |

| Microloans | $500–$50k | Startup essentials | Bakery equipment |

| Invoice Financing | Based on invoices | Unlock tied-up cash | B2B agency payroll |

| Revenue-Based Financing | $50k–$250k+ | Growth with variable revenue | SaaS scaling ads |

👉 Each option has trade-offs. For example, term loans are predictable but less flexible, while lines of credit are flexible but harder to qualify for. Invoice financing solves cash flow delays but costs more in fees. Understanding these differences helps founders choose the right fit.

To qualify for an unsecured startup loan, expect lenders to review:

If you can’t get an unsecured startup loan, don’t worry. Options include:

It’s challenging, but not impossible. Traditional banks are less likely to approve, but microlenders, nonprofit programs, and revenue-based financing platforms may work with founders who have little or no credit history. You’ll need to show a strong business plan, projections, and personal commitment to the business.

Yes, in most cases. Even if collateral isn’t required, many lenders ask for a personal guarantee, meaning you’re personally responsible if the business cannot repay. Some lenders may also file a UCC lien against future business assets.

Most lenders look for a 600–680+ personal credit score. Higher scores (700+) unlock better rates and larger loan amounts. Some alternative lenders may work with lower scores if you can show strong revenue or other strengths.

Online lenders / fintechs: 24–72 hours in some cases.

Banks: Several days to weeks, depending on documentation.

SBA-backed loans: Weeks to months due to government processing.

Loan amounts vary widely:

Microloans: $5,000 – $50,000

Unsecured term loans: $10,000 – $100,000

Lines of credit: Up to $150,000 in some cases

Remember, the stronger your credit and business revenue, the higher the loan amount you may qualify for.

Term loans

Lines of credit

Business credit cards

SBA microloans

Invoice financing / factoring

Revenue-based financing

Each type serves different needs, from cash flow management to long-term growth.

Yes, but options are limited. New businesses may qualify through:

Personal credit-based financing

Microloans

Crowdfunding or peer-to-peer lending

Business credit cards

Having a co-signer or guarantor can also improve approval chances.

Secured loans: Require collateral (real estate, equipment, inventory). Lower risk for lender, so rates are usually better.

Unsecured loans: No collateral, but usually higher interest, shorter terms, and personal guarantees.

Yes. Because lenders take on more risk, they charge higher interest rates and fees. Rates can range from single digits with strong credit to 30%+ with higher risk profiles.

Yes, in some cases. For example, SBA microloans (up to $50,000) sometimes do not require collateral. However, most SBA 7(a) loans require collateral if available, but approval doesn’t automatically hinge on it.

Generally yes. Lenders allow broad use of funds for:

Not always. Some lenders approve pre-revenue startups if the founder has excellent personal credit or strong outside income. Others require a minimum monthly revenue (e.g., $5,000–$10,000).

You’re approved for a maximum amount (e.g., $50,000). You borrow only what you need, when you need it, and pay interest only on the borrowed portion. As you repay, funds become available again — like a credit card but usually with lower rates.

If the business can’t repay, the lender can pursue your personal assets — savings, income, or even property — depending on the guarantee terms. Always read the fine print before signing.

Yes. If your startup has multiple owners, lenders may require all owners with 20%+ stake to sign personal guarantees. This spreads risk among founders.